Building regenerative carbon markets with web3 🌄

Web3 is unlocking innovation in financial and carbon markets, creating opportunities for regenerative approaches to tackle the climate crisis.

Our Founder James Farrell recently explored this exciting intersection at ETH Barcelona, introducing key features of the emerging regenerative finance movement, voluntary carbon markets and how they can come together to drive innovation.

Here we dive into:

- What is regenerative finance (ReFi)? 🌴

- Issues with the voluntary carbon market (VCM) 💫

- Web3 for regenerative carbon markets 🔑

- Toucan's vision 🦚

Enjoy! 🌞

1. What is ReFi? 🌴

Climate change is recognised as the most pressing global challenge of our time. The emergence of this crisis cannot be attributed to any one group or individual, arising instead from multiple systemic failures over time.

A key failure is the operation of our financial system.

This system currently works by seeking to drive everlasting economic growth, while contributing little value to the environmental and social resources needed to maintain the system. This results in a host of negative externalities, as these resources are freely exploited to drive economic growth. This includes the release of greenhouse gas emissions into the atmosphere, destruction of habitats and displacement of local economies.

Conversely, ReFi systems seek to redirect some of the financial value generated back into maintaining and regenerating the environmental and social resources upon which the system relies. This transforms the financial system from solely extracting economic value to being in service to growing, protecting and regenerating the value of a system.

“Regenerative finance refers to business practices that restore and build rather than exploit and destroy” - John Fullerton

ReFi approaches are rooted in the theory of regenerative economics, which explore how to create systems that both maintain and restore the physical resources essential for human well-being.

If economies embed regenerative elements, then the more active they are, the more regeneration takes place. This flips the current relationship between financial profit and the environment on its head, enabling their expansion side by side, paving the way for entirely new opportunities.

Indeed, in relation to carbon emissions, ReFi markets can be developed that move beyond neutralizing existing emissions to removing more carbon than enters, regenerating the atmosphere. These compounding benefits produce multiple positive system characteristics, that ensure constant innovation and longevity, explored below:

Some examples of regenerative frameworks that could enable this transformation include Kate Raworth’s Doughnut Economics; John Elkington’s triple bottom line; John Fullerton’s 8 Principles of Regenerative Economics; and Charles Eisenstein’s work on Sacred Economics.

2. Issues with the voluntary carbon market (VCM) 💫

The VCM is a market-based approach to reducing and removing carbon dioxide from the atmosphere.

The VCM enables carbon credits, generated by projects that reduce or remove carbon dioxide from the atmosphere, to be sold to polluting organisations to compensate for their carbon footprint. Each credit represents one tonne of carbon, with a large amount of current supply coming from projects that protect forests.

VCM demand has grown rapidly since 2018 in response to the Paris Agreement, representing a key opportunity to accelerate climate action. In 2021, the VCM’s value rose to over $1bn for the first time and is expected to exceed $100bn by 2030.

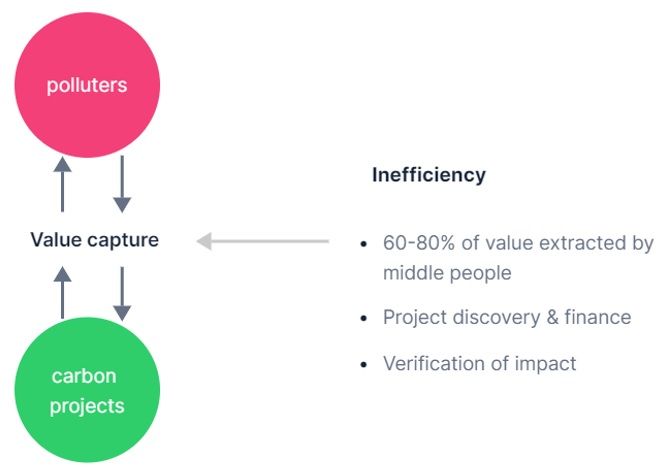

Despite this massive growth potential however, the market is plagued by many inefficiencies:

- Transactions are opaque, conducted as over the counter deals which cause a lack of price discovery.

- Brokers and middlemen are able to add large mark-ups to the credits they sell, constituting 60-80% of the total sale value.

- Low market visibility prevents buyers from understanding what credits are available and their attributes, while project developers lack clear demand signals and upfront finance for the solutions they provide.

The resulting lack of transparency leads to high financial risk, leading to cases of non-delivery and even fraud. These issues are made worse by centralised market structures, which require high levels of understanding and existing networks to even access.

If the VCM is to scale at the pace required therefore, rapid innovation is needed to improve transparency, integrity and unlock the true climate action potential of these markets.

3. Web3 for regenerative carbon markets 🔑

Web3 represents a structural innovation that can play a central role in addressing the climate crisis.

Indeed, the ability of public blockchains to record data in a decentralized, secure and accessible way creates revolutionary opportunities to improve market integrity, transparency and cost effectiveness. These opportunities are already being explored by global institutions including the UN Environment Programme, World Bank and World Economic Forum.

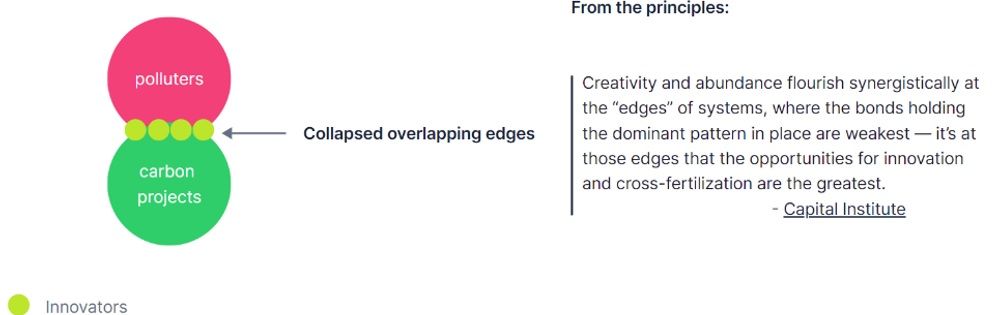

Web3 applications therefore enable new ways for financial and market actors to interact, allowing ReFi principles to be embedded in the VCM.

This enables the removal of market intermediaries and creates the conditions for carbon project developers and polluting organisations to interact much more closely. This unlocks the regenerative principle of ‘edge effect abundance’, in which innovation can take place at a rapid, uninhibited pace.

Web3 can therefore drive:

- Transparent price discovery, leading to greater opportunities for investment across the VCM supply chain.

- Transparent project aggregation and data availability, improving market visibility and integrity.

- New opportunities for carbon credits to become tokenized and compatible with smart contracts, enabling them to be embedded into web3 projects.

- New opportunities for effective market intermediaries, such as those providing digital MRV or quality ratings.

- Decentralised governance and dramatically reduced barriers to VCM entry, enabling anyone to own and sell carbon credits.

4. Toucan's vision 🦚

At Toucan, our vision is to bridge the gap between carbon markets and web3.

Our core hypothesis is that the VCM will be the first essential building block of a regenerative economy. A unified global carbon market brought onto the blockchain will catalyze opportunities to embed ReFi principles, with increasing growth driving regeneration.

Over the last 10 months we have learnt and achieved a lot…

- Bridged 25 million carbon credits from the Verra carbon registry onto the blockchain- 4% of current market supply.

- Embedded ReFi principles into out protocol, with 75% of fees collected from those using our bridge to tokenize carbon credits reinvested into offsetting additional credits. This means the more the protocol is used, the more carbon is reduced or removed from the atmosphere.

- Created two tokenized carbon token pools- the base carbon tonne (BCT) and nature carbon tonne (NCT), with NCT containing some of the most prestigious nature-based projects in the Verra registry.

- Supported over 120 teams of web3 builders that are seeking to embed tokenized carbon into their products- including emissions offsetting and gaming infrastructure.

We look forward to seeing what amazing innovations emerge in the web3/ carbon space over the coming months and years! ✨

💻 You can watch James’s full presentation on web3 and regenerative economics here.

Toucan is building the technology to bring the world's supply of carbon credits onto energy-efficient blockchains and turn them into tokens that anyone can use. This paves the way for a more efficient and scalable global carbon market.