The world’s first liquid market for biochar

Could onchain climate action hold the key to a sustainable future? CHAR, Toucan’s newest RWA, suggests that it might.

Could onchain climate action hold the key to a sustainable future? CHAR, Toucan’s newest RWA, suggests that it might.

The new CHAR carbon pool represents a significant step forward in creating a more efficient and transparent carbon market. It works by bundling carbon removal credits that share similar attributes. This results in world-first liquidity for an otherwise illiquid and inefficient market. It also enables programmable carbon, where carbon removal can be integrated into the broader landscape of web3 innovation: carbon-backed assets, green NFTs, regenerative DeFi, and more.

What is CHAR and how does it work?

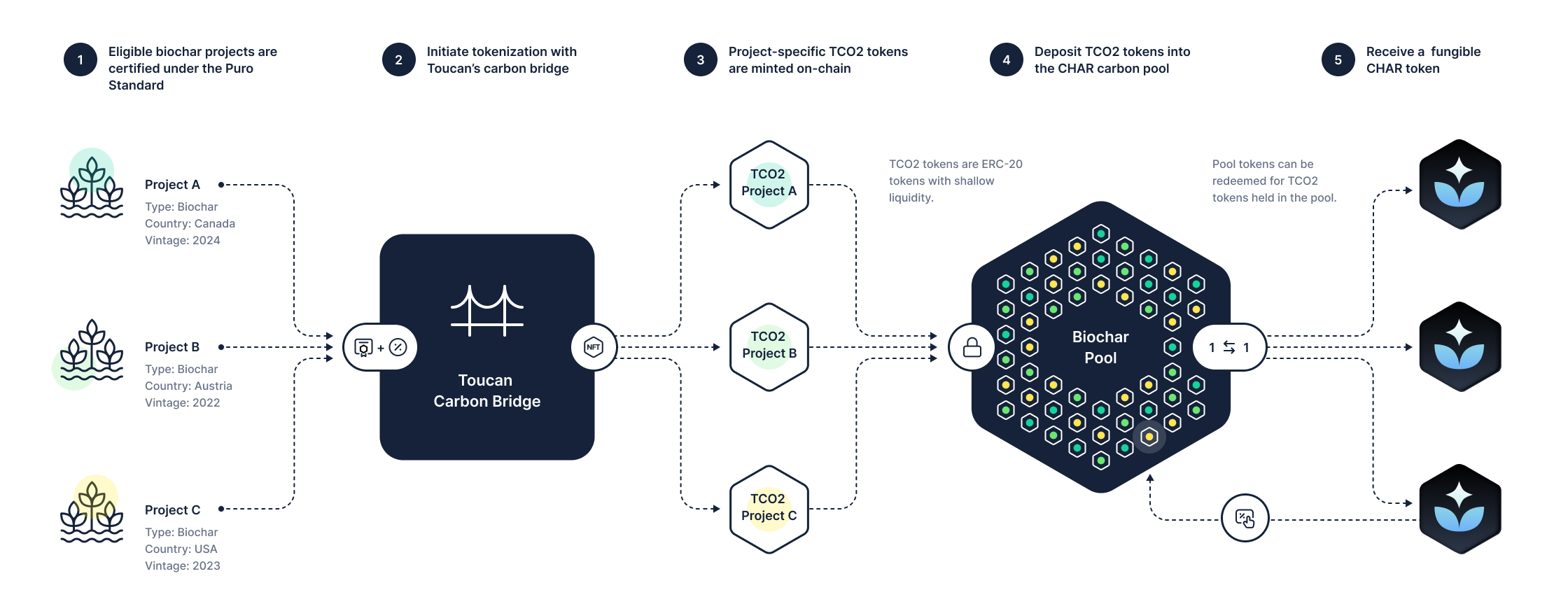

It begins with tokenization, in which users bring carbon assets from connected source registries such as Puro.earth onchain. Tokenized credits (TCO2s) are then minted on a 1-1 basis, where each TCO2 represents one tonne of carbon removed from the environment.

Once onchain, eligible TCO2s can be deposited into a carbon pool:

- A carbon pool has its own rules, or filter, which defines which TCO2s are eligible. The filter must be set wide enough to enable liquidity while also not being set so broadly that the lowest priced projects dominate the pool makeup. For CHAR, this is an allow list of biochar projects certified by Puro.

- Each carbon pool has its own carbon pool token (e.g. CHAR).

- For every TCO2 deposited into a pool, a carbon pool token is minted.

- Carbon pool tokens can be redeemed for TCO2 tokens held in the pool. Think of them like vouchers that provide access to the underlying credits.

Thus, the CHAR carbon pool facilitates the conversion of Puro removal credits into CHAR tokens, which have liquid markets and transparent, real-time pricing.

We’re pleased to have launched the first liquid market for CHAR on the Celo blockchain, which is closely aligned with our mission to scale climate finance. CHAR is available for purchase and trading on Uniswap.

CHAR contract address on Base: 0x20b048fA035D5763685D695e66aDF62c5D9F5055

CHAR contract address on Celo: 0x50E85c754929840B58614F48e29C64BC78C58345.

Driving pool diversification

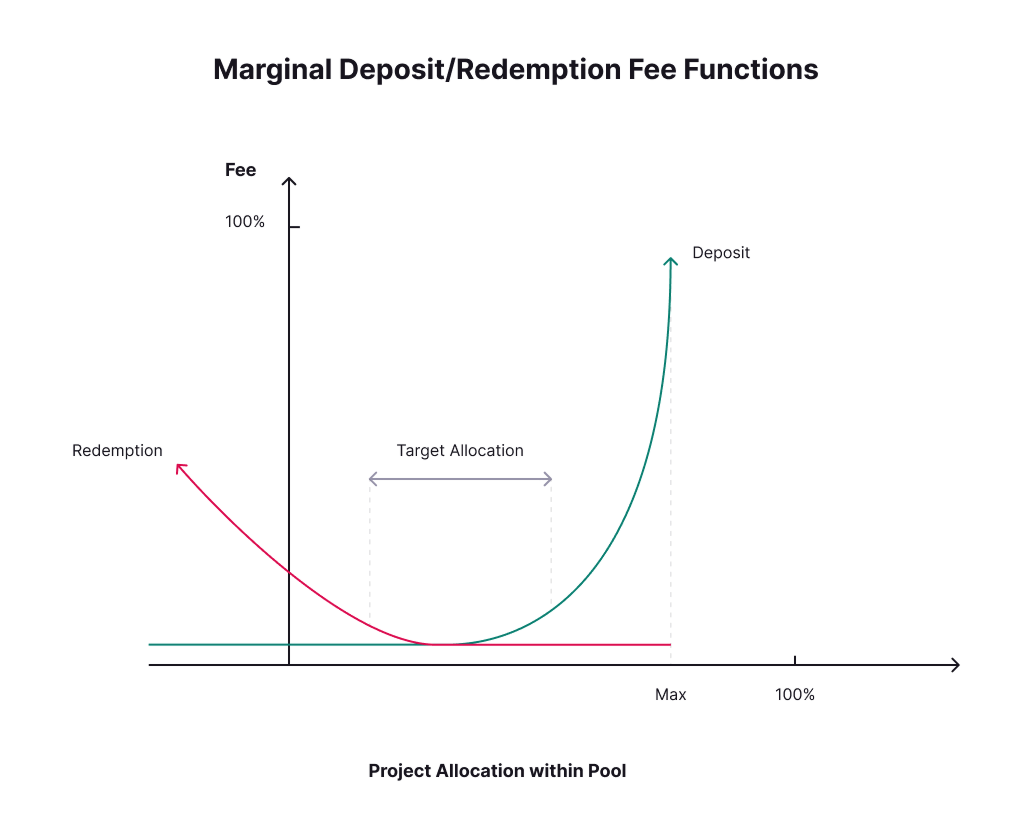

A key challenge in carbon pool design is to maintain the attributes that make each project unique on the TCO2 level, while fostering standardization for liquidity on the pool token level.

In past designs, our carbon pools suffered from a “drag to bottom” pattern, where the most desirable TCO2s in the pool were redeemed first. This dragged the pool’s overall project mix downward.

To address this, Toucan and its launch partner, Neutral, designed a pool health adjustment module. The system applies dynamic fees to deposits and redemptions, promoting increased project TCO2 mix and enhancing the pool's overall health and attractiveness.

For TCO2 deposits, the adjustments reduce the number of CHAR tokens received by the depositor. The adjustment amount increases as a project's composition within the pool rises.

For CHAR redemptions, the adjustments reduce the number of TCO2 tokens received by the redeemer. The adjustment amount increases as a project's composition within the pool falls.

Onchain climate solutions to address a warming planet

Doughnut economics proposes a model for an earth that thrives within its planetary boundaries. It envisions a sustainable economy that doesn’t overstep ecological limits.

But in today’s system, where we don’t accurately price emissions, our trajectory is far from balanced. We’re operating outside of the doughnut boundaries and CO2 levels are rising at an alarming rate. We’ve reached the point where there’s no debate that the planet is warming – fast.

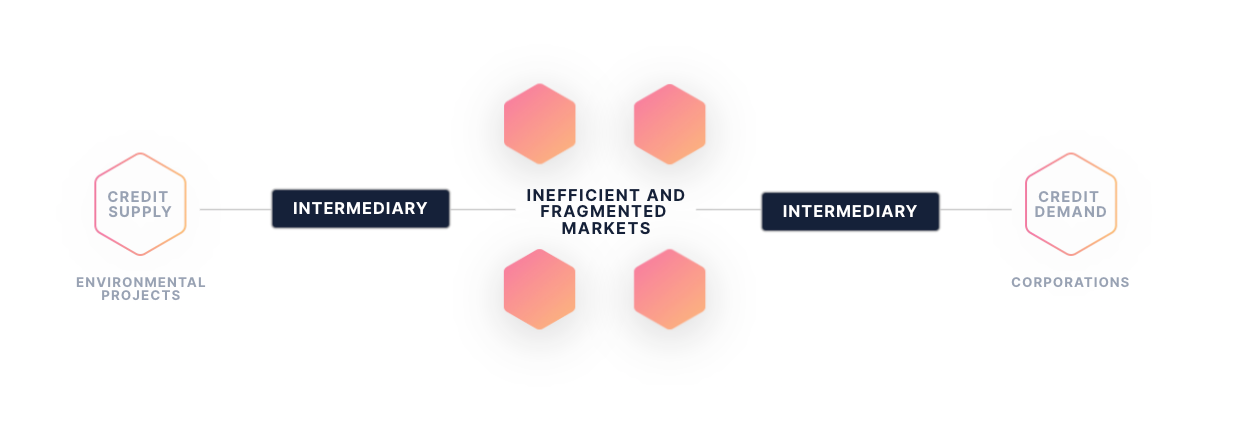

This is where carbon removal plays an important role in helping us get back to an equilibrium. The problem? Carbon market infrastructure is broken.

Carbon markets are fragmented, opaque, inefficient

Carbon removal markets are predicated on the exchange and retirement of carbon credits, each representing a quantifiable amount of carbon dioxide removed from the atmosphere. These markets incentivize carbon-negative activities by allowing entities that remove CO2 to sell credits to buyers.

Within the umbrella of carbon removal there are two overarching types: nature-based solutions (e.g. planting trees) and technology-assisted carbon dioxide removal (CDR).

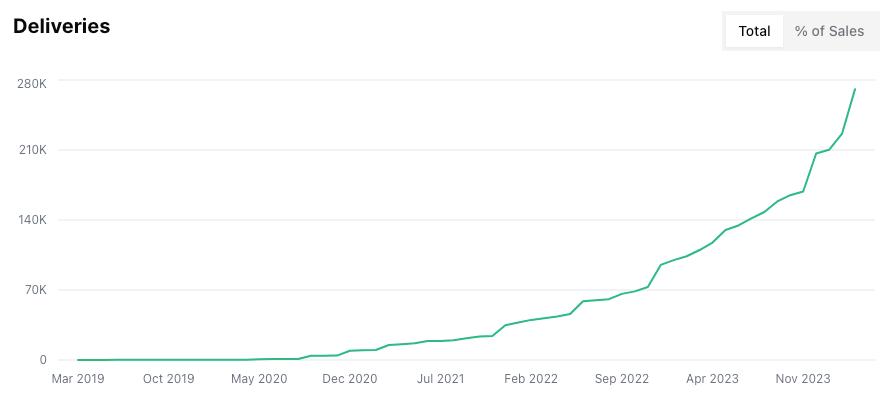

CHAR falls within the segment of CDR, which is growing quickly due to the high integrity and verifiability of the credits. A recent report from Boston Consulting Group predicts that the CDR market will grow from $370 million in 2022 to $8.1 billion by 2028 – an impressive 31% compound annual growth rate.

Despite their potential, carbon markets face many challenges.

A primary obstacle to the scalability of carbon markets is inefficiency. Unlike many commodity assets, carbon credits are not homogeneous; they possess a variety of attributes that influence their market value. Similar to how wine is appraised based on varietal, region, and vintage, among other factors, carbon credits are evaluated according to a range of key attributes.

Resulting from this lack of homogeneity, carbon credit trades occur predominantly through over-the-counter (OTC) transactions where brokers extract a significant amount of value.

Carbon markets also suffer from fragmentation across a long list of standards organizations, registries, and siloed markets with poor or non-existent interoperability and data exchange.

CDR onchain: infrastructure for scale

Fundamentally, carbon markets suffer from poor infrastructure. They’re in a state akin to Web 1.0. To transition carbon markets to meet the scale required by global climate goals, we must unlock bottlenecks and expand market participation.

Enter CDR onchain: an open carbon stack that provides everything needed to unlock the potential for carbon markets.

For project developers, this means a streamlined way to sell carbon credits, enabling quicker reinvestment and operational scaling. Buyers benefit from instant settlement, transparent pricing, and enhanced risk assessment tools.

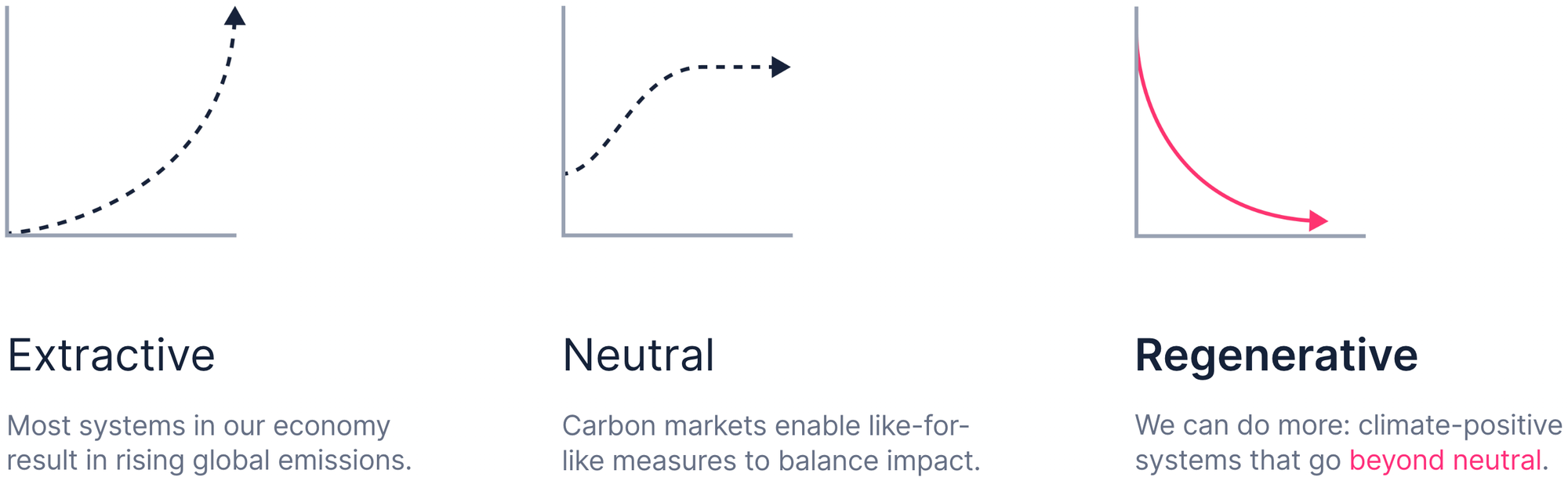

Further, onchain CDR infrastructure enables systems that are regenerative by design – systems that go beyond neutral and help to regenerate the earth. Imagine a purchase or transaction that removes more than it emits. Or a game, where users are rewarded for driving climate action.

Onward 🌱

Building a world of prosperity within our planet’s ecological limits is within our grasp. We are optimistic. But we can’t do it alone and at this critical moment, we need you: builders, creators, and entrepreneurs.

Here’s how you can get involved:

- Builders: Integrate climate action into your applications by leveraging CHAR – the first programmable and liquid carbon removal asset.

- Content creators: Educate, educate, educate. Teach readers why climate action matters. Spread the word on how to build systems that are regenerative by design. Push builders, organizations, and individuals to participate.

- Organizations: Work with Toucan to compensate for your carbon footprint. Support climate action while benefiting from a liquid, transparent market.

- Asset managers: Consider CHAR as a means to diversify into clean, nature-based commodities, aligning financial objectives with environmental benefit.

Want to learn more? Head to our documentation to get started. You can also find us in Discord, on X, or by sending a message to hi@toucan.earth.