Why the VCM needs more transparency

Improving transparency in the rapidly growing VCM was a major topic of conversation in 2022. More transparency increases trust and participation in the market.

The Voluntary Carbon Market (VCM) can be a powerful tool for financing high-integrity climate solutions. It’s growing rapidly — from $2 billion in value in 2021 to a predicted $50 billion in 2030. But it’s important to ensure the integrity of carbon credits for the VCM to have real climate impact. And the public needs to build trust and gain confidence in carbon mitigation efforts. Market transparency plays a crucial role for this.

Improving transparency in the VCM was a major topic of conversation in 2022. In June, the Integrity Council for the Voluntary Carbon Market (ICVCM) chair Annette Nazareth stated that many companies were looking at carbon credits as a credible way to accelerate a net-zero transition — but more transparency is needed: “Companies have reputations and shareholder duties to uphold, and they want to be sure that all of these activities [in the credits] are real, verifiable and measurable.” And David Antonioli, CEO of carbon credit registry Verra, emphasized that “uncertainty, confusion and concern” need to be eliminated from the VCM.

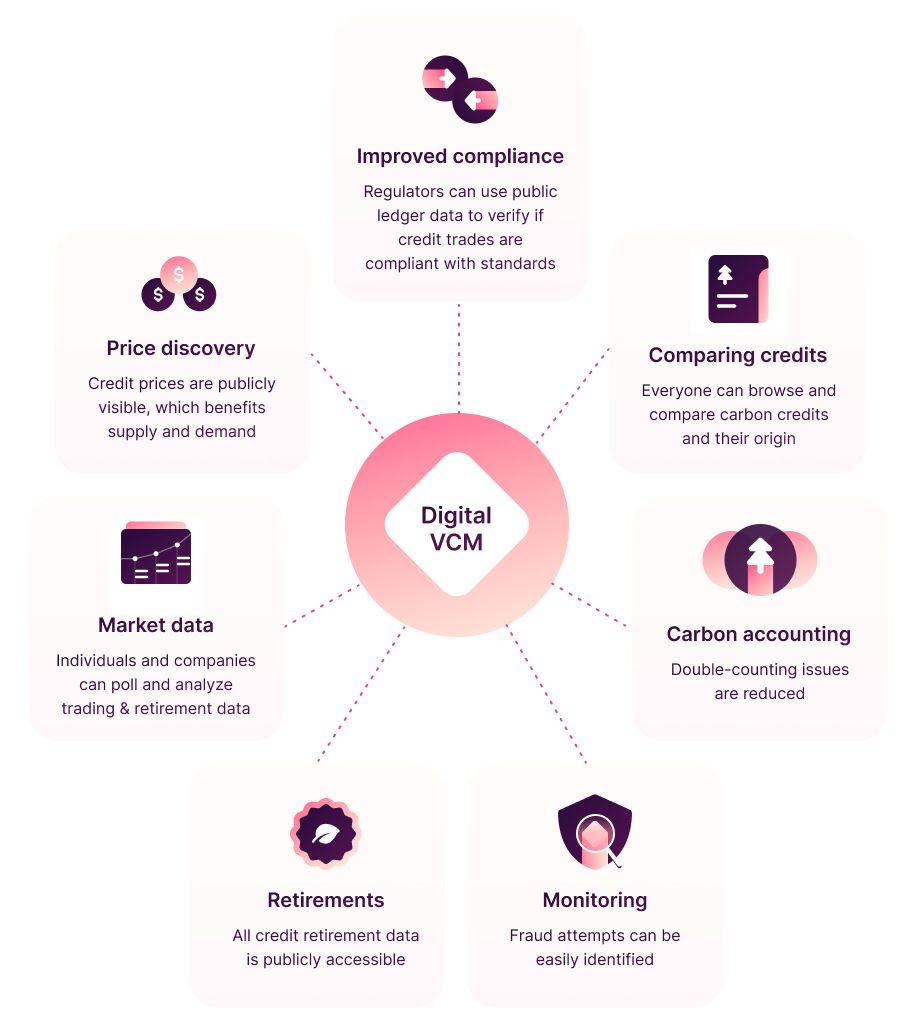

That’s where a digital, blockchain-powered carbon market comes in. Carbon credit details and trading data stored on public ledgers are tamper-proof, can be viewed by everyone, and provide a level of transparency that previously didn’t exist.

💡 What is the Voluntary Carbon Market (VCM)?

Companies around the world are racing to reduce their carbon footprint, with many pledging to meet “green” regulatory and voluntary goals as part of their sustainability efforts. To achieve these targets, carbon credits can be used as part of a high-ambition, science-based pathway to net-zero. A carbon credit is essentially a unit that represent the removal or reduction of carbon emissions.

In the Voluntary Carbon Market (VCM), individuals and organizations can purchase carbon credits from projects that reduce or remove greenhouse gases from the atmosphere, in order to compensate for their unabatable emissions along that high-ambition pathway. These climate projects span everything from renewable energy and reforestation to improved agricultural practices. It’s worth highlighting that nature-based solutions (NBS) are key to stabilizing the climate. On top of emissions reductions, they provide other valuable benefits and protect ecosystems and biodiversity.

3 big transparency bottlenecks in the conventional VCM

- Lack of standardization

There are many different carbon credit standards, and it’s difficult to judge the quality of credits across standards. Credit developers also may use divergent methodologies to calculate emissions reductions, which, again, makes it challenging for buyers to identify the projects that provide the most significant emissions reductions. - Double-counting of carbon credits

This refers to the same carbon credit being sold to multiple buyers, or to credits being resold while also claimed as retired. Double-counting of environmental impact claims leads to a pronounced lack of trust in the market, and also results in an overestimation of the actual reduction of carbon in the atmosphere, because one credit is counted multiple times by different entities. - No clear price signals

The prices of carbon credits vary widely. Credits can be sold for as little as 1 dollar and as much as 900 dollars per tonne. This is partially due to different credit attributes and methodologies. But it can also be ascribed to over-the-counter trades done in private, and the resulting lack of publicly accessible pricing data. Without ways to compare the cost of similar credits, it’s challenging for buyers to evaluate if they’re paying a fair price for their credits. It can also be difficult to make informed decisions about which carbon credits to purchase, which in turn results in an overall lack of trust in the market.

Solutions based on transparent, verifiable, and open data encourage projects to develop more high-integrity carbon credits and other environmental assets. These solutions also address several of the inefficiencies currently plaguing the VCM, like lack of transparency and data silos. A high level of transparency is vital for the evolution of environmental markets and the Regenerative Finance space. It builds trust that environmental efforts at the core of these markets are impactful.

Marc Johnson, Climate & Web3, Filecoin Green at Protocol Labs

How can a digital carbon market improve transparency?

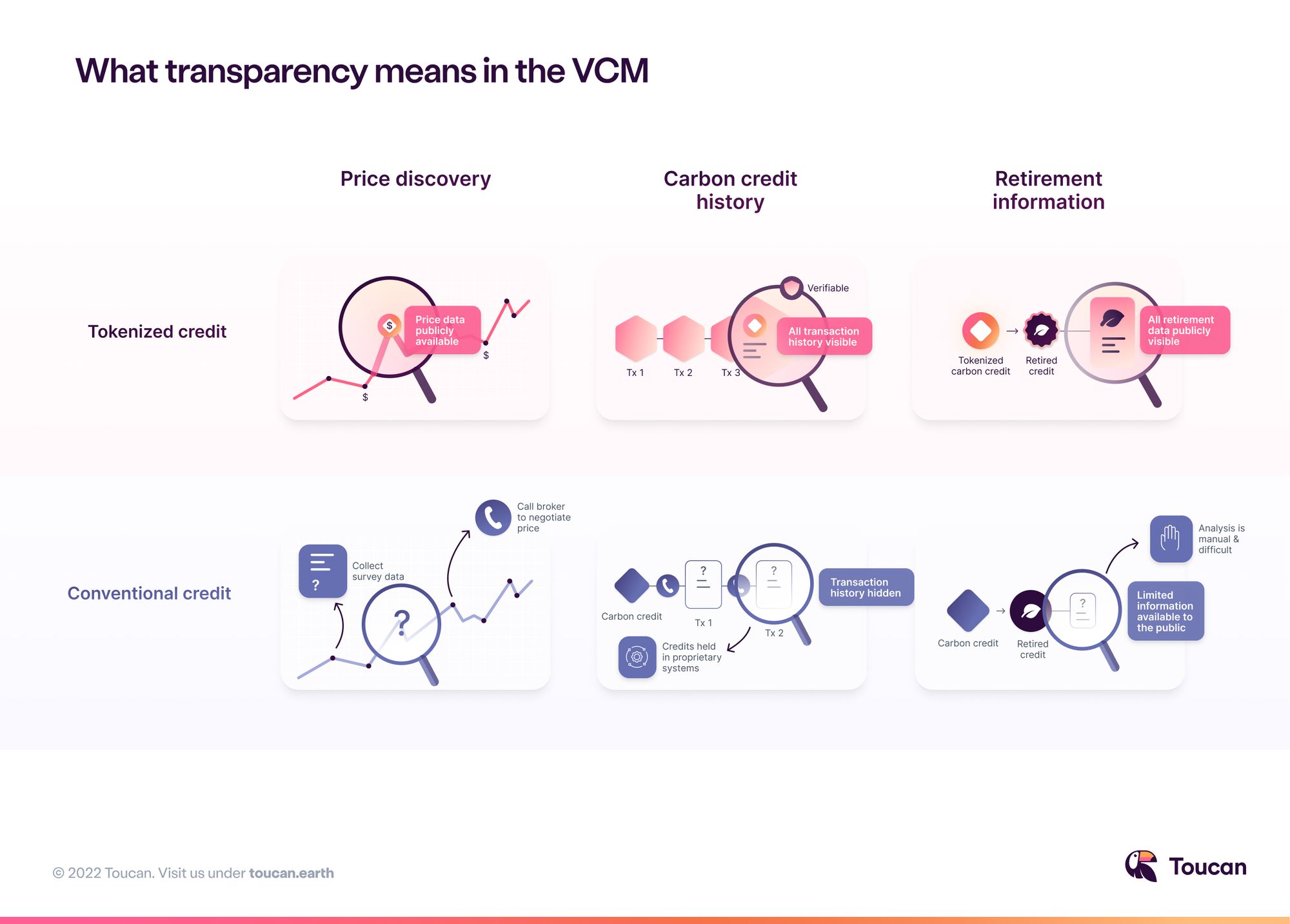

Carbon markets built on blockchain technology offer a level of transparency that previously didn’t exist. To make this more understandable, let’s compare to the conventional voluntary carbon market, where market activity takes place behind closed doors, and depends on electronic infrastructure that is difficult to use and understand. By contrast, in a digital voluntary carbon market, applications are built in the open, and everyone can review or audit their transaction data and business logic. At all times, individuals can easily and autonomously gain insight on the origin and life cycle of digital assets, like tokenized carbon credits, including on transactions that have been executed by others.

How can we leverage blockchain technology for the VCM?

Blockchain technology is essentially a global public ledger system - and that is perfectly suited to power an accessible and transparent carbon market. When a carbon registry is built on a blockchain, it provides a transparent digital record of every existing carbon credit in the system. Users can easily discover, track, and purchase credits across standards, and market participants can view market activity and credit prices, and verify retirements that back net-zero claims.

Blockchain technology also enables anyone to check if carbon credits are legitimate, because everyone can track and verify the ownership and trading history of each credit. And they provide information about which carbon credits have been retired, because, again, all records are publicly visible. These aspects boost confidence among buyers and sellers, and increase trust in the effectiveness of the carbon market to finance climate solutions.

The voluntary carbon market is at a turning point. Increasing transparency is fundamental to scaling the market effectively, to improving credit integrity and building confidence in carbon markets. Every facet of the market needs independently verified and standardized information that is easily acessible. Market mechanisms such as ratings agencies and blockchain-enabled businesses help push the transparency agenda forward.

Tommy Ricketts, CEO & Co-founder, BeZero

Transparency in carbon markets for supply, demand and regulators

What does transparency mean for carbon credit developers (supply side)?

- Carbon credits can be compared by more people: Credit developers can easily list their credits with all attached attributes on blockchain-powered peer-to-peer marketplaces to reach buyers from different backgrounds and with various budgets for their climate investments. That makes selling credits faster and easier, and it reduces the need for middlemen.

- Fairer prices: Selling credits on blockchain-powered marketplaces is cheap, and payments happen instantly. Transaction costs on blockchain-powered marketplaces are marginal, and trading fees, as well as credit prices, are public information. This enables both buyers and sellers to check and compare credit prices to make sure they’re trading at a fair rate.

- Automatic compliance checks: Smart contracts on the blockchain can automatically verify compliance with established standards and regulations. This makes it easier for suppliers of credits to adhere to regulations, and to advertise their publicly verifiable compliance status.

- Better financing for project developers: Typically, carbon project developers use pre-purchase agreements to access financing for their work. It works as follows: a buyer will agree to purchase credits from the project developer at a future point in time and for a certain price. This process de-risks the project from the owner's perspective, as it guarantees future sales. It also enables them to get bank financing to help with ongoing operational costs. But it can be tricky to agree on the right price, because the lack of clear price signaling in conventional carbon markets can force sellers to offer their credits at a steep discount. However, if pre-purchase agreements are stored on public ledgers, then people and smart contracts can access openly available pricing data. That helps the project owner with negotiations. It also makes the buyer more comfortable, because smart contracts can auto-execute pre-purchase agreements once credits have been developed, which is reducing counterparty risk.

How do carbon credit purchasers benefit from more transparency? (demand side)

- More efficient markets: Buyers can easily browse and compare credits across standards, registries and methodologies. They can also interact directly with sellers. This reduces the time and effort required to find and purchase suitable credits.

- More information about carbon credits: Everyone can query any carbon credit record — from the moment it is added to a blockchain registry through the moment of retirement. Publicly accessible data includes information on when credits have been sold, and for what price. Buyers can also view data on the origin of credits, which again helps them make informed purchasing decisions that suit their climate strategy.

- Verifiable climate action: Offsetters can make instant carbon retirements and share their impact story along with a tamper-proof record of the carbon credits they retired. This is one of the unique value propositions of a digital and transparent carbon market, as double-counting issues and false credit retirement claims have in the past shaken trust of the public in the VCM.

How regulators benefit from more transparency in carbon markets

- Monitoring market activity: Blockchain systems collect a host of publicly accessible trading data. This makes it easy for regulators to monitor market activity and identify potential issues or fraud attempts. Carbon credits can be tracked throughout their lifecycle, which makes it easier to detect fraud.

- Double-counting issues are reduced: Carbon credits can only be sold once at a time. And when they are retired via blockchain-based systems, they are permanently taken out of circulation and can’t be resold again.

It can be difficult to verify if a company has purchased carbon credits, or to check neutrality or net zero claims. Often, we just have to take their word for it. Having a way to see exactly how many and what kind of credits an organisation has retired would substantially increase the transparency of carbon reporting. If done properly, digital carbon markets could make it much easier to check business claims, define best practices, and see who the real climate leaders are.

Sophia Kesteven, General Manager, TechZero

- Verification of net-zero claims: Corporates currently are making net-zero claims that depend on unverifiable carbon retirements. In contrast, retirements done on blockchains are visible to all, and climate action data can be showcased and shared via intuitive and personalized dashboards.

- More market data: Blockchain-powered trades deliver a stream of accurate, tamper-proof data. This data can be used for market analytics, to inform policy decisions and reveal areas that need to be developed further.

- Improved compliance: Regulators can enforce compliance with more ease. For example, they can use public ledger data to track the origin, quality, and ownership of carbon credits, and verify if credits are traded in compliance with established regulations and standards. Additionally, smart contracts can automate compliance checks like KYC.

💡 How does the conventional VCM tackle double-counting issues?

Carbon credit markets use legal agreements, like mandatory retirement conditions and legal covenants, to prevent the double counting of carbon credits. These agreements set rules and regulations to make sure that carbon credits are not used more than once, and that retired credits are not resold after retirement. However, these agreements are not always enforced, because the surrounding procedures can be cumbersome and expensive. This especially applies to smaller transactions, which may not be worth the cost of investigation.

Conclusion

Transparency is key to an efficient and functioning carbon market. Credit developers, consumers, and regulators benefit from increased transparency. Businesses can build climate strategies that suit them, and find exactly the right credits to purchase and retire. Standards bodies also have an easier time monitoring the market, identifying fraudulent cases and introducing targeted measures that make the VCM better.

Transparency also increases trust — and more trust in the VCM means that more people will participate in climate financing, which helps us address the climate emergency faster.

What is Toucan?

Toucan is building technology to unlock climate action at scale. Our digital infrastructure is helping to grow the voluntary carbon market (VCM) in a transparent and high-integrity way. It increases the flow of revenue to the most effective climate impact projects, by bringing established and nascent environmental assets on the blockchain.