Decoding Verra, Gold Standard responses to IC-VCM’s draft carbon principles

How different stakeholders view the Integrity Council's core carbon principles, and how it could shape the voluntary carbon markets going forward

On June 27, the Integrity Council for the Voluntary Carbon Market (IC-VCM) unveiled the much-anticipated draft Core Carbon Principles (CCP). This was heralded as the voluntary carbon market's (VCM) first tentative step into a brave new world of verifiable, high-integrity carbon credits—and, subsequently, scaling of the VCM.

Simply put, the purpose of the draft CCPs is to identify a broad consensus of what constitutes a high-integrity carbon credit. That is, a credit with verifiable climate impact and a net positive impact on both environment and society. Linked to the draft principles are Assessment Frameworks (AF), and procedures, which essentially provide practical tools or processes to help assess ‘CCP-eligible’ credits.

On September 27, as the public consultation around the principles and the associated frameworks came to a close, opinions were divergent at best. Here, we will analyze the concerns raised and clarifications sought by two of the biggest carbon standards—a microcosm of the entire spectrum of debate.

Verra, while welcoming the scrutiny over crediting programs, questioned the “one-size-fits-all”, “blunt” approach, and “far too prescriptive” requirements. “Our support for the IC-VCM has been shaken,” Verra said.

Gold Standard, while admitting that the “difficult” role of the crediting standards “will not be made easier” by the latest requirements, said that the draft CCPs will “help instill trust and secure the foundations of the carbon market”.

Let us dive in deeper, with a bit of context at first.

Voluntary vs compliance carbon markets

Broadly speaking, both the voluntary and compliance markets perform the same function; they both price carbon in tonnes. Compliance markets cover certain sectors, which governments regulate with a cap on emissions and distribute allowances—businesses that pollute below the cap can trade their allowances.

The VCM is a different beast, where private entities can ‘voluntarily’ purchase or sell offsets that represent certified reductions/removal of greenhouse gas emissions (GHGs) in the atmosphere.

Scaling the VCM is very important because most compliance markets cover a limited amount of activities, and there are ample opportunities for a fully developed market system for environmental assets like carbon to evolve.

Importance of carbon credit integrity

In early 2022, when carbon credits ratings platform Sylvera surveyed Environmental, Social and Corporate Governance (ESG) decision-makers in the UK and the US, the single biggest concern over VCM was failure of transparency. As the report stated, both voluntary and compliance markets evolved in parallel, aided by frameworks like the 1997 Kyoto Protocol, 2015 Paris Agreement and Article 6 of COP26. But, what the VCM lacked, unlike compliance markets, was regulation.

This opened up the market to all sorts of inefficiencies and friction, mainly resulting from the lack of an agreed definition of what qualifies as a credit in the voluntary market; therefore, carbon in the VCM is not a commodity.

- Standards fragmentation (different credits use different criteria) and double counting were rife.

- There were low price transparency and high mark-ups.

- Risk of non-delivery of contracts further bogged down the market.

IC-VCM chair Annette Nazareth concurs. In the latest episode of Redefining Energy podcast, Nazareth highlighted the need to fully prioritize credit integrity as the immediate stepping stone to scale.

Nazareth said that many companies are committed to net zero, and have looked at carbon credits as a way to accelerate that transition. But, first, companies have reputations and shareholder duties to uphold; they would want to be absolutely sure that all of the activities (mentioned in the credits) are real, verifiable and measurable.

The podcast appearance was also a revealing portal into IC-VCM’s vision of what the voluntary markets should look like in the future.

- IC-VCM’s role is to bring traditional market principles into the carbon markets space, [that is] end-to-end transparency, liquidity, trade reporting, registries. The aim is create a voluntary market that is regulated-lite, mimicking a regulated market in as many aspects as possible.

- The development of a global standard would result in much more effective pricing mechanisms, with better price signals and more efficient and consistent pricing.

With all this background in mind, let us go into the weeds of what the Integrity Council has proposed.

What are the CCPs and AF recommendations?

The Council has recommended a phased approach to implementation of the CCPs—that is, an initial threshold in line with current good practices, leading to a level up to full stringency requirements.

Before delving into how the principles will be practically implemented, a brief overview of the principles:

❗ Our public consultation on the draft #CoreCarbonPrinciples is closing tomorrow.

— Integrity Council for the Voluntary Carbon Market (@ic_vcm) September 26, 2022

💡This is to ensure the final documents reflect genuine diversity of expertise, knowledge & opinions.

💭 Share your views now ↓https://t.co/XXg1bTJNY1

- Robust governance: This requires that carbon-crediting programs be transparent about who oversees the program and that roles and responsibilities are assigned and discoverable.

- Robust validation and verification: Third-party auditing is a key tool for consistency, transparency, and integrity, and to help create and sustain confidence. Carbon-crediting programs must have third-party audit requirements which ensure impartiality and minimize potential conflicts of interest.

- No double-counting: A key concern over the integrity of carbon credits is the potential for different claims to be simultaneously backed by the same carbon credit; in other words, the same emission reduction or removal leading to overlapping claims. Problematic double counting should be distinguished from necessarily nested accounting. That is, there should be no double issuance, double use and double claiming.

- Registry maintenance: A registry is used by programs to record and track mitigation activities and carbon credit transactions. An operational and well-maintained registry system is crucial, and credits should be able to be traced back to the mitigation activity associated with it.

- Mitigation activity information: Mitigation activity documentation should be publicly available, along with access to the decisions and analyses behind an emission reduction claim.

- Ensuring sustainable development: Carbon-crediting programs should play an important role in ensuring that mitigation activities identify, assess and disclose the potential risk of environmental, economic and social harm. Net positive impacts should be the aim.

- Additionality requirements: This is fundamental to the spirit underlying CCPs. Additionality means that a carbon credit must result from a mitigation activity’s emission reductions or removals that would not have taken place except for incentives associated with the carbon price.

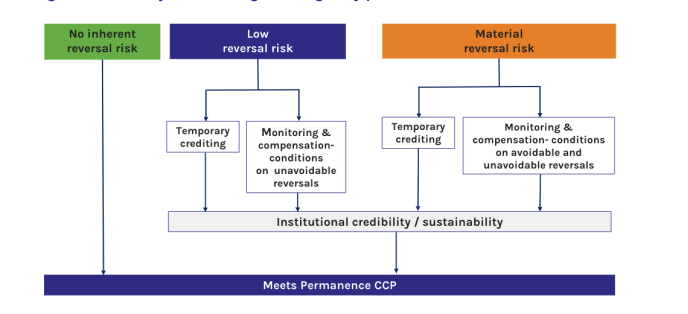

- Permanence of mitigation: Permanent mitigation of CO2 is essential to ensure long-term goals of the Paris Agreement. However, many activities that enhance or preserve carbon stored in geologic or land-based reservoirs experience some reversal risk. Say, an afforestation project that burns down due to a wildfire. Reversible (impermanent) mitigation still has a role to play, and this can be incorporated by several measures like requiring crediting them on a temporary basis.

- Robust quantification: Emission reductions and removals from mitigation activities must be robustly quantified, implying reliable, conservative estimates of emissions reductions or removals.

- Transition towards net-zero emissions: Technology, even if it leads to short-term emission reductions, should be discouraged if it would result in a locked-in increase in long-term emissions.

How are CCPs implemented practically?

The main thing to understand is that the principles will be implemented along different tiers.

- First, the certifying agency’s carbon-crediting program will have to be assessed. Carbon credits will be deemed CCP-eligible only if the associated carbon-crediting program and type/methodology has been successfully assessed.

- Then the Council assesses the integrity of the carbon credit type (usually interchangeable with methodology, but does not always map 1-to-1).

- Once these steps are finished, the agency, overseen by the Council, will identify and tag ‘CCP-eligible’ credits.

Complexities could emerge. If the agency runs more than one carbon-credit program (like Verra runs Verified Carbon Standard, Jurisdictional and Nested REDD+ program), the assessment will have to clearly state which program, track and unit types are being evaluated, along with the version of methodology.

Verra’s response to the draft CCP framework

Verra has released a statement expressing its view that the ICVCM should drastically revise its process for developing the Core Carbon Principles (CCPs) and Assessment Framework (AF) for the voluntary carbon market. https://t.co/ptsfzRImVF#carbonmarkets #climateaction

— Verra - Standards for a Sustainable Future (@VerraStandards) September 21, 2022

Some of the points raised:

- Verra urged the Integrity Council to draw itself back to a level of just assessing programs on whether they appropriately determined additionality and methodologies. That is, assessments would only be issued at the program level. Decisions could still be examined on a lower tier, but in a targeted manner—like sampling or spot checks.

- The agency warned that the IC-VCM process was at risk of impeding necessary climate action. If too much time and effort was spent defining and assessing the minutia of VCM processes and methodologies, it will become an impediment to scaling activity and create significant distortions in the market, Verra stated.

- Verra proposed that the ‘initial’ threshold and ‘full’ stringency requirements (for phased implementation) be replaced with ‘versions’. That is, imaginably, version 2 of the AF could be introduced 1-2 years after version 1 is established.

- One proposal called for IC-VCM to leverage the assessment undertaken in the CORSIA GHG program review as much as possible, citing considerable overlap with the assessment framework for the CCP.

- Along the lower tiers, Verra also proposed changes when it came to double counting principle (too broad); robust quantification of removals/reductions (include ‘accuracy’); and public availability of mitigation documentation (some project documentation is business confidential and/or protected as a trade secret).

Gold Standard’s response to IC-VCM

Gold Standard has submitted its response to the Integrity Council for the Voluntary Carbon Market (IC-VCM) consultation. We welcome the proposals put forward as a positive step. 🧵1/5

— Gold Standard (@goldstandard) September 27, 2022

- Gold Standard, while welcoming the role that the IC-VCM and the CCPs can play to provide assurance of quality, stated that the right balance has to be struck between ‘rigor’ from the Council framework, and flexibility for standards to innovate, to move quickly.

- When it comes to additionality, Gold Standard argued that well-run standards have robust assessment procedures in place. The organization urged against any additional regulatory hurdle for the adoption of new methodologies or approaches.

- Gold Standard said that CCPs, for all their benefits, will add cost and resource burden to the market, which will be at least partially transferred to projects. This could be a net negative for developing country/vulnerable community projects. The organization recommended easing of requirements reflective of the challenges faced in those contexts.

- Sustainable development contributions and co-benefits should be stated explicitly, and the projects that contribute positively should receive a ‘CCP+’ tag for sustainable development.

- The organization proposed a much stronger definition and rationale for the issues caused by double claiming—a problematic version of double counting.

- When it came to alignment with net-zero principles, Gold Standard recommended that IC-VCM establish a dynamic ‘negative list’ of technologies and mitigation activities that are deemed incompatible with the long-term emission goal.

Conclusion

There are just no right or wrong answers here. The draft CCP is, without doubt, a net positive, sprinkled with all the right intentions. At the same time, Verra raised a lot of relevant concerns on the ability of the agencies to move nimbly and innovate along the ground tiers. And, Gold Standard walked that tight-rope between fully backing all attempts to restore ‘rigor and trust’, and urging against any additional regulatory hurdle. As always, a stable middle ground might have to be the way forward.

Toucan is building the technology to bring the world's supply of carbon credits onto energy-efficient blockchains and turn them into tokens that anyone can use. This paves the way for a more efficient and scalable global carbon market.