Carbon reduction and removal for net zero 📉

As markets for durable carbon removals have started to expand, there is increasing discussion over the role played by reduction and removal carbon credits in the journey towards net zero.

This article seeks to understand this evolving landscape, exploring:

- 📉 Voluntary carbon markets (VCMs) and the Paris Agreement

- 💡 How reduction and removal credits differ

- ✨ Increasing popularity of carbon removal

- 🤝 Why both are needed for net zero

📉 VCMs and the Paris Agreement

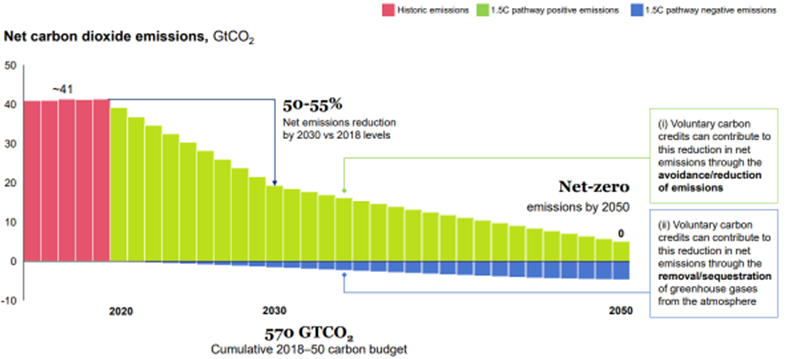

COP26 represented the last UN Climate Conference with the potential to uphold the key aim of the Paris Agreement of limiting global warming to 1.5°C. To achieve this, by 2030 emissions need to have reduced 45% below 2010 levels to remain on track to net zero emissions by 2050.

While progress is being made, decarbonisation rates need to double for the 2030 target to be met. We therefore have 8 years in which to drive rapid low carbon transformation, accelerating the emergence and adoption of low carbon solutions needed to drive whole systems reconfiguration.

Voluntary carbon markets (VCMs) play a role in meeting this massive challenge, initially by encouraging the reduction of emissions and then increasingly their removal to 2050.

Since the Paris Agreement was ratified in 2016, a major upswing of private sector activity has kickstarted VCM activity. In 2018- 2019, oil and gas majors started to launch ‘carbon neutral’ initiatives that involved the purchase of offsets, while the aviation industry launched the CORSIA scheme to reduce and offset emissions. 2020 saw increased momentum across the whole private sector, with 1000s of companies making net zero commitments, for example via the Science Based Targets Initiative.

Indeed, over the last few years, VCMs have grown at an unprecedented rate. In 2021, volumes traded until August were already 27% higher than all of 2020, with the market’s value rising over $1bn for the first time.

It therefore appears that the VCM is set to step up and play an ever increasing role in accelerating progress towards net zero. Its ultimate effectiveness however, will depend on the climate impact of carbon credits that it sells.

💡 How reduction and removal credits differ

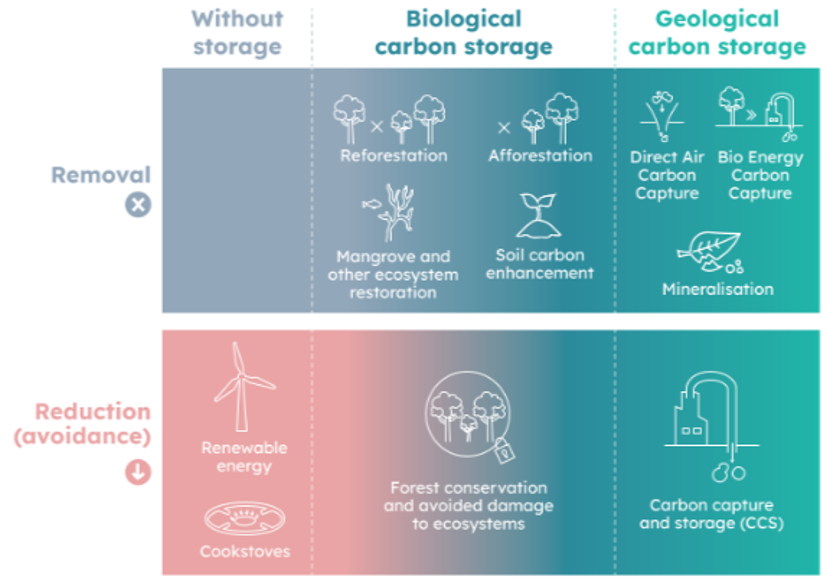

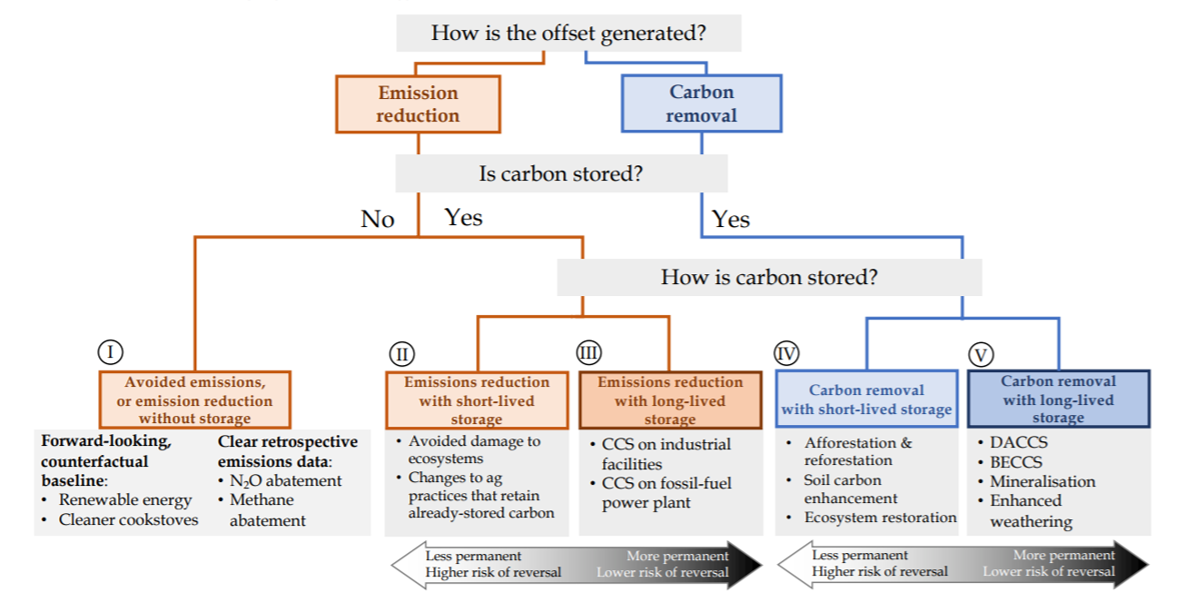

At present, the VCM primarily consists of carbon reduction credits. These are produced by projects that avoid the release of a tonne of CO2 where it otherwise would have been emitted, for example by supporting a switch from fossil fuels to renewable energy use.

Some reduction methodologies may involve elements of removal and storage, such as forest conservation projects, which store carbon biologically as biomass, or carbon capture storage (CCS) projects, that store CO2 geologically underground.

Removal credits are different to reduction credits in that they remove a tonne of CO2 that has already been emitted into the atmosphere, as opposed to avoiding the release of more. This is achieved by locking CO2 into biological or geological storage, via the restoration and enhancement of forests, coastal ecosystems and soils; or via carbon capture and mineralization techniques. You can find out more about key removal technologies here.

It is possible therefore, for both reduction and removal projects to store carbon either biologically or geologically, as depicted in the diagram below.

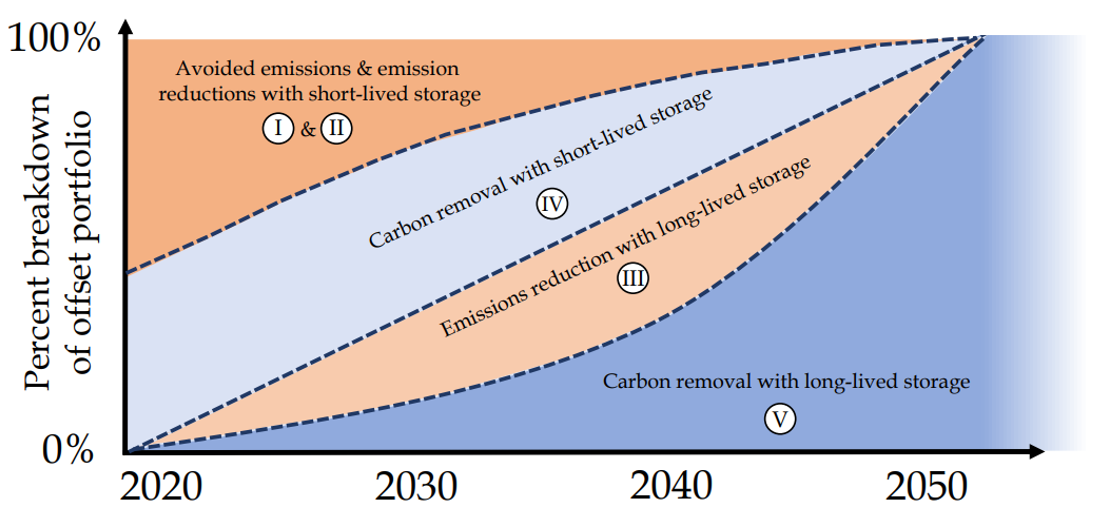

Biological storage by nature-based solutions is generally viewed as shorter-term and less uniform, with a higher risk of reversal, whereas geological storage is viewed as longer-term and more precise, with a much lower risk of reversal. Both avoidance and removal credits can therefore provide short and long term carbon storage options.

As detailed by the Oxford Principles for Net Zero below, all credit types are needed on the pathway to net zero, with a definite shift towards supporting longer-term removals from 2040 onwards.

✨ Increasing popularity of carbon removal

Several approaches to nature-based carbon removal are already well established, with reforestation and afforestation projects currently accounting for 13% of nature based credits in VCM registries. Farmland and wetland removals constitute an additional 5%.

Removal credits have received a recent surge in popularity in relation to longer-term carbon removal credits, such as direct air capture (DAC) and mineralization, alongside ongoing expansion of shorter-term, nature-based solutions. This has been driven by two key trends.

⚙ Technological innovation

While renewables technologies like wind and solar PV are well established, DAC and other removal technologies remain in the earlier stages of innovation. This means that they aren’t yet commercially viable, both in terms of technology development and the policy and regulation needed to support large scale deployment.

Over recent years however, innovative companies have started to reach a stage where they are able to produce a low but consistent amount of long-term removals. These include companies like Climeworks, who are developing a DAC technology that will capture 4000 tonnes of carbon a year. The current cost of their removals is $600 a tonne, which is anticipated to decrease to $200- $300 a tonne by 2024. Their progress is behind schedule however, highlighting that these solutions still face ongoing innovation challenges.

An interrelated technology development is that of increasingly intelligent measuring, reporting and verification (MRV) tools. These include internet sensors, satellite tracking and remote sensing, which can more quickly and efficiently collect data on VCM project features, such as forest cover and air quality.

These technologies are important as they bring more rigor and conformity to project reporting processes and open up opportunities for lower cost, community level data recording. This can particularly benefit nature-based removal projects, making it possible to accelerate project development in remote regions.

👔 Corporate demand for high integrity credits

While it is possible for organizations to obtain carbon reduction credits for $2-3 for certain projects, their effectiveness towards net zero claims can be disputed.

Some 40% of VCM credits currently purchased by organisations are based on older renewables and REDD+ reduction methodologies, which are now considered to have questionable climate impacts. This has served to drive down both the price and effectiveness of these offsets, raising concerns over greenwashing by those using them.

While the purchase of high quality removal credits remains expensive, some notable firms including Stripe, Alphabet and Microsoft, are now seeking to go one step further with their corporate commitments, spending large amounts per tonne of carbon to support innovative removals technologies. As evidenced here, some 30 organizations have now committed to paying $100’s and even $1000’s a tonne for carbon removal credits.

This behaviour is additionally driven by emerging narratives around the purchase of credits as an investment into innovative firms without offsetting the associated emissions. This shifts mindsets beyond viewing carbon credits solely as a means to offset operational emissions and as a way to leverage the VCM to directly invest in climate action.

Organizations are additionally showing a preference for credits that possess sustainability co-benefits, that not only offset their carbon footprint but demonstrate a commitment to environmental, social and governance (ESG) targets. Many co-benefits are associated with nature-based removal solutions, meaning that although carbon storage may be shorter term, organizations may be willing to pay a premium for smaller, high-quality removals projects that directly support local populations, like agroforestry.

🤝 Why both reductions and removals are needed for net zero

As carbon removal credits directly remove carbon from the atmosphere they are viewed by some as better than reduction credits, which instead reduce the amount of carbon. When offsetting these credits however, so long as the credit is of high integrity, then the same outcome is achieved.

This perhaps seems counter intuitive, as reduction offsets mean that a company will still emit one tonne of carbon while avoiding another elsewhere, whereas removal credits directly remove the tonne that the company emits. Without reduction credits stemming the overall flow of carbon into the atmosphere however, removal offsets would not be able to get rid of the carbon being emitted fast enough to reach net zero.

🔑 Integrity is key

The most important thing to consider, in relation to both reduction or removal credits, is their integrity in relation to their ultimate climate impact. Every credit should demonstrate additionality, permeance and accuracy (explored further here), which depend on the methodology of the particular project from which they derive.

Another aspect of integrity is based on the potential sustainability co-benefits these projects bring communities, primarily in the global south. These are primarily associated with both reduction and removal nature-based projects, such as forest protection and mangrove restoration. Therefore, while these projects may not offer long-term removal, they can bring sustainability and climate impacts beyond engineered solutions like DAC. Supporting and scaling high integrity reduction and removal credits is therefore key.

If this can be teamed with the advances in innovative digital MRV solutions discussed above, then concerns over additionality and permanence can be ongoingly managed and overcome to develop highly impactful projects.

⌚ Long-term removals need time to scale

While supporting the innovation of long-term removal solutions now is a great way to accelerate their growth, investing in such expensive credits remains out of reach to many companies. Additionally, the number of these credits is very limited, representing the first of an emerging market. Early adopters therefore face a lack of strong definitions and standards around these solutions, with any investment requiring a lot of due diligence.

In contrast, high integrity carbon reduction projects are available now, at scale. This protects existing carbon sinks, which is more cost effective than replacing these assets or capturing carbon from the atmosphere later, while securing irreplaceable ecosystem and social capital.

It is therefore not currently viable to rely solely on the long-term removals market to meet growing VCM demand, with it critical to invest in the scaling of both removal and reduction solutions for net zero.

Conclusion

As global progress continues towards net zero targets, both reduction and removal credits will be key in moving towards this goal. Over the coming years, shorter-term reduction and removal credits will remain of key importance, while long-term removal technologies and methodologies will innovate and scale to 2050.

The wave of support for high-integrity removal credits from large firms demonstrates a trend in supporting innovative climate solutions beyond just offsetting. There also remains high demand for nature-based reduction and removal projects, with sustainability co-benefits viewed as desirable.

As the VCM scales, ensuring the integrity of all offsets is key to claiming that both reduction and removal credits credibly contribute to net zero targets.

Check out our previous posts for more on credit integrity, co-benefits and emerging CDR technologies ✨

Toucan is building the technology to bring the world's supply of carbon credits onto energy-efficient blockchains and turn them into tokens that anyone can use. This paves the way for a more efficient and scalable global carbon market.