Scaling VCM Integrity Pt 2: Quality of demand 🛒

In our last post, we explored what makes a high quality carbon credit and their essential role in scaling the VCM. Their effectiveness ultimately however, depends on being used to meet the high quality demand of offsetting organisations.

In this piece, we explore what should be considered high integrity demand and the role of high quality offsets in delivering an organisation’s net zero targets.

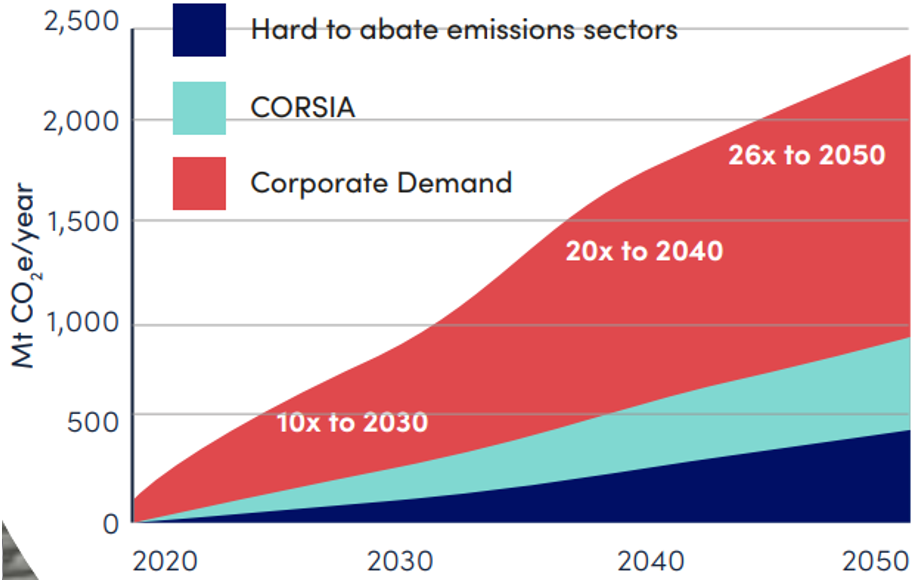

Growing demand

In recent years, the VCM has grown at an unprecedented rate. In 2021, volumes traded until August were already 27% higher than all of 2020, with the market’s value rising over $1bn for the first time.

This growth has been accelerated by corporate offsetters, as engagement with net zero narratives has increased. 60% of Fortune 500 companies have now made climate commitments, alongside many other of the world’s largest companies pledging to reach net zero by 2050. According to the Net Zero Tracker, nearly 40% of companies surveyed intend to use carbon offsets to achieve these aims.

It is important however, to understand what exactly net zero commitments entail and the role that carbon credits will play in their achievement, with analysis revealing often gaping holes in current company strategies.

There are several reputable standards under which commitments are being made, such as the WCSBD’s Natural Climate Solutions Alliance and the Science Based Targets Initiative (SBTi). Indeed, the SBTi’s Net-Zero Standard is the world’s first framework that enables corporates to develop a net zero target in line with climate science, limiting global temperature rise to 1.5°C.

Used as part of a comprehensive strategy like the SBTi, two key aspects ensure that carbon credits are used to drive effective climate action:

- Scope 1-3 emissions are first minimized, with carbon credits used only to offset residual or harder to abate emissions

- A shift in the longer term from carbon reduction to carbon removal credits

1. Scope 1-3 emissions

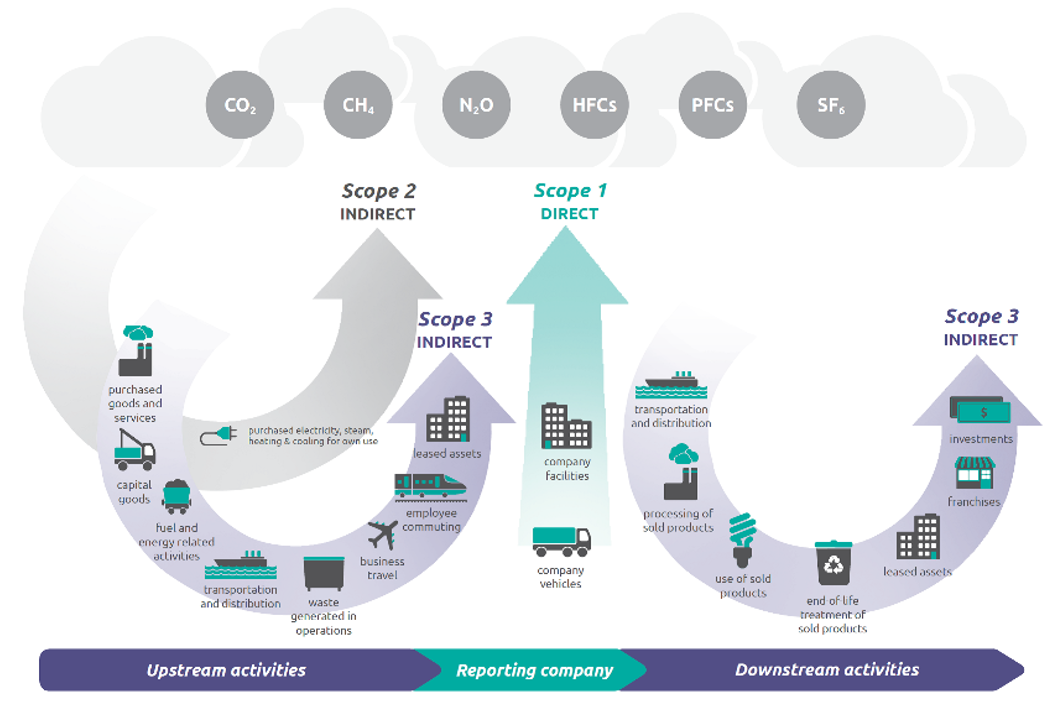

For an organization to make credible net zero claim, it is essential to address both the emissions relating to their direct operation and those indirectly associated with their broader supply chains. These are collectively known as scope 1, 2 and 3 emissions, detailed below.

Scope 1 and 2 emissions are produced by an organization’s facilities, company vehicles and energy use. These emissions sources are more within direct organizational control, presenting clear opportunities to measure and reduce them. An organization’s decarbonization plan should therefore seek to tackle these source first, for example by improving energy efficiency or switching to 100% renewable energy or electric vehicle use. This is where most offsetting efforts have been focused to date.

Scope 3 emissions are more difficult to address, as they are produced by all other upstream and downstream activities associated with an organization’s supply chain and operations. This includes the individual travel choices of staff, production and transportation of goods, how products are used after they are sold and any external investment portfolios. These activities are more granular, with data less readily available on their impact and often not within immediate control.

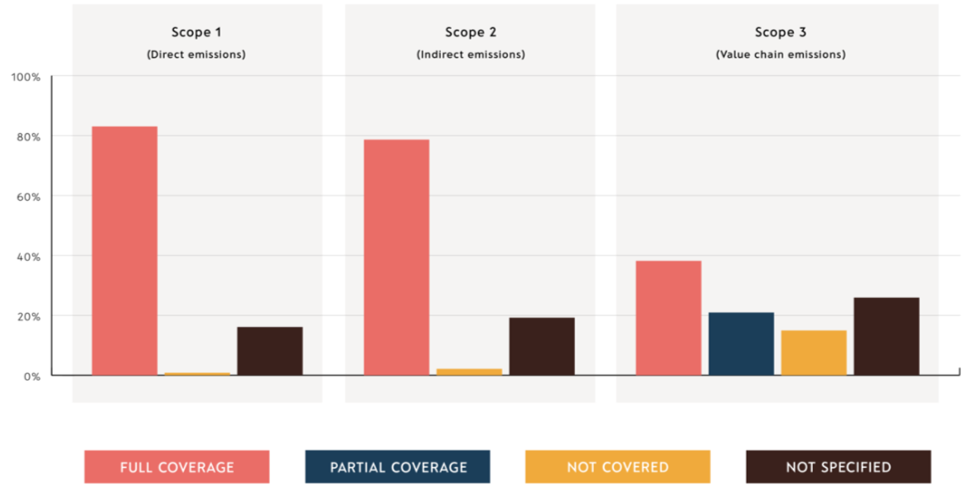

Scope 3 emissions are therefore considered much more difficult to reduce and more likely to require the purchase of carbon credits to offset their production. Indeed, according to the most recent net zero tracker report, only 38% of companies currently claim to have accounted for all scope 3 emissions.

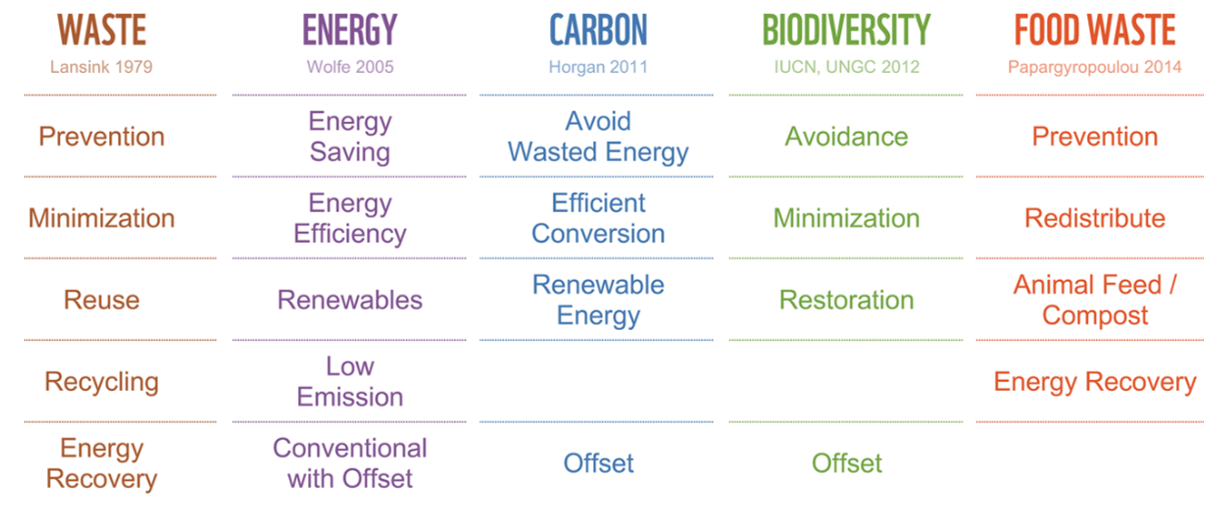

High integrity carbon credit demand should therefore seek to use the smallest number of credits possible primarily to offset scope 3 emissions. This is reflected in the ‘mitigation hierarchy’ developed by the WWF, depicted below.

While it might be tempting to skip the first few layers of the hierarchy and compensate emissions directly, this has suboptimal to detrimental impact and can lead to accusations of greenwashing. Additionally, the amount of offsets used should reduce over time, as investment in tackling scope 1-3 emissions increases.

Blockchain and web3 technologies could be particularly effective in bringing greater transparency to decarbonizing scope 3 supply chains. For example, partner companies could account for goods moving to different locations and the associated emissions using a publicly accessible, immutable recording system. Such monitoring would enhance the transparency and verifiability of the reporting process, allowing organizations to access accurate data from suppliers to determine their environmental impact.

Additionally, blockchain-enabled smart contracts could be used to verify that carbon credits are used only in line with the mitigation hierarchy outlined above. For example, a tokenized carbon credit could be programmed to be offset only if data on mitigation actions had been measured, recorded and verified.

2. Embracing removals

For any net zero commitment to meet this goal, unavoidable carbon will ultimately need to be removed from the atmosphere using carbon removal credits.

This is identified in the Oxford Principles for Net Zero Aligned Carbon Offsetting, which outlines how over time organizations should move towards utilizing removals credits with long-term storage, like direct air capture or mineralization.

At present, these credits remain largely unavailable within the VCM but will become much more prevalent over the next ten years. This shift will therefore be quite gradual and require organizations to ongoingly assess their offsetting approach. While some argue that continuing to allow for the use of carbon reduction credits may confuse or even invalidate claims around ‘carbon neutrality’, they remain essential in the short term.

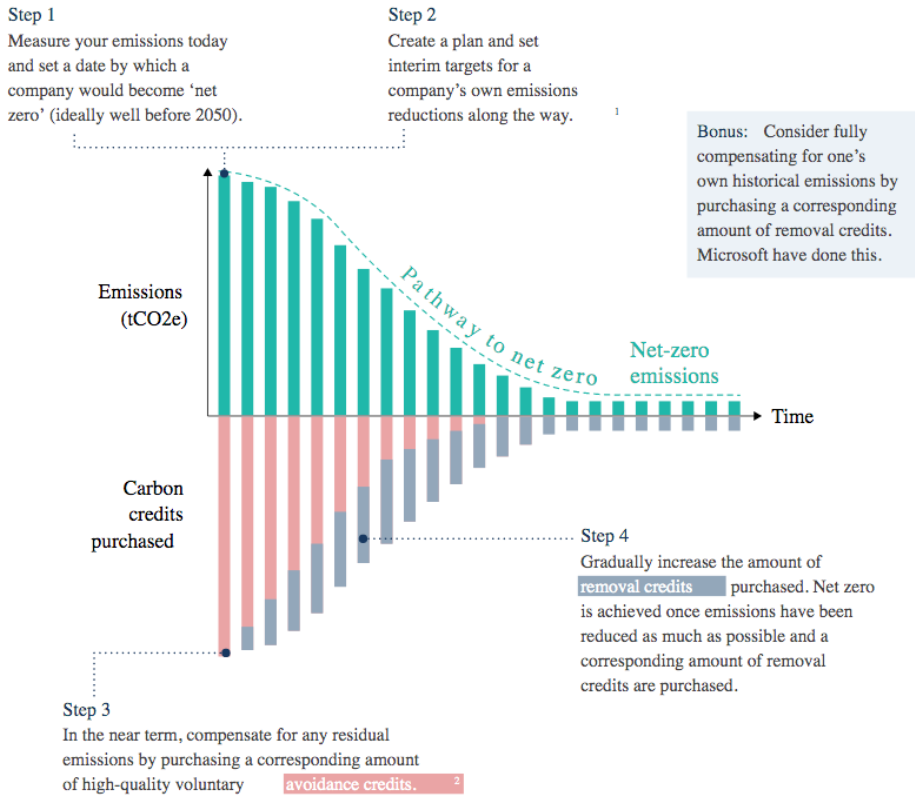

The diagram below shows how minimizing scope 1-3 emissions alongside utilizing high quality carbon reduction then removal credits will progress towards net zero over time.

Guaranteeing quality demand

Ensuring that net zero pledges and plans translate into transparent, verifiable action over time is key to guaranteeing their effectiveness. Developing a common understanding of what high integrity demand looks like therefore needs to empower multiple industries and sectors to develop net zero aligned plans.

One such standard under development is the Voluntary Carbon Markets Integrity Initiative (VCMI) recently released a provisional Claims Code of Practice. The Code comprises four steps that organisations should take to make credible claims about their use of voluntary carbon credits:

- Ensure that a science-aligned decarbonization target has been adopted

- Identify whether to make enterprise wide or brand/ service level claims

- Purchase high quality carbon credits from a recognized standard, which where relevant include protecting human rights and promoting positive social and environmental co-benefits

- Report transparently on the outcomes of these offset projects

Participants will then receive a Gold, Silver or Bronze rating, depending on the amount of credits purchased to cover their carbon target and any potential undershoot. The Code therefore seeks to reward achievement and incentivise ongoing improvement.

Over the next 3 months a range of firms will trial the implementation of the Code; 11 organizations have already signed up, including Google, Unilever and Hitachi.

Greater transparency around offset use could also be enabled by web3 platforms, which could permanently showcase carbon credit retirements for public scrutiny, with all data available through one real-time dashboard. This would also enable ongoing rating and monitoring data to be attributed to each credit, ensuring that past issues relating to accusations of greenwashing can be avoided.

Our final post in this series will explore the integrity of market operation in enabling high quality VCM growth ✨

Toucan is building the technology to bring the world's supply of carbon credits onto energy-efficient blockchains and turn them into tokens that anyone can use. This paves the way for a more efficient and scalable global carbon market.