How blockchains could support a more scalable way for climate finance

We've teamed up with World Economic Forum to research how blockchain technology is unlocking ways to create a more transparent and efficient carbon market.

Bitcoin has been criticized for its energy consumption, but there’s far more to blockchain’s climate impact! An ecosystem of emerging projects is building climate-positive infrastructure with blockchain technology. A recently published WEF whitepaper identifies four key impact areas for blockchain’s potential for climate solutions.

If you’d like to know more about the paper, we encourage you to reach out to its lead authors Anna Lerner and John Hoopes.

Much has been written about the negative climate impact of Bitcoin mining, and reports are primarily relating Bitcoin to the carbon emissions released by its high energy consumption. In the past, this has led to concerns about the sustainability of blockchain technology as a whole. But it is important to understand that Bitcoins emissions are far from the full story. And: Blockchain technologies are unlocking many new opportunities for positive climate impact.

First of all, not all blockchains function similarly when it comes to energy consumption. Bitcoin’s proof-of-work mechanism is by far the most energy-intensive, compared to other blockchains.

Secondly, blockchain communities are increasingly aware of their environmental impact, and many are taking active steps to mitigate this. An example is the Ethereum blockchain with its cryptocurrency Ether (the second-largest cryptocurrency by market capitalization). In September 2022, the Ethereum blockchain transitioned to a proof-of-stake mechanism, which replaced its energy-intense proof-of-work mechanism when mining new blocks. This switch has reduced Ethereum's energy consumption by 99%, as it no longer requires miners to solve complex mathematical problems to validate transactions.

Who is working on making blockchains more sustainable?

Various initiatives and movements have formed under the objective to compensate for blockchains’ unavoidable emissions – future emissions as well as their historic carbon footprint:

- The Ethereum Climate Platform (ECP) was initiated to offset Ethereum's cumulative carbon emissions. Its members include blockchain-centric firms as well as Microsoft, ERM Consulting, and the carbon registry Gold Standard. ECP is currently calculating Ethereum's historical emissions, before unveiling its technology platform and investment vehicle.

- The Crypto Climate Accord is dedicated to achieving a carbon-neutral cryptocurrency sector by 2040. Notable participants in the Accord include Ripple, CoinShares, and ConsenSys.

- Climate Collective unifies key players that are building reliable, eco-friendly digital infrastructure to drive measurable climate action on a large scale. This supports both environmental health and a sustainable financial system.

- The Polygon blockchain is a prospective scaling solution for Ethereum. It turned carbon-neutral in 2022. Polygon has dedicated $20 million to community projects that focus on the use of Web3 for a sustainable future.

- Celo represents another carbon-neutral blockchain, and it is known for its accessible mobile-first design. Celo also offers grants to startups that are building climate tech solutions.

- Lastly, the Hedera blockchain aims to accomplish carbon-negative network operations. To reach this objective, they acquire quarterly carbon offsets with requirements that are determined by the third-party provider Terrapass.

Driving positive climate action

Once the focus moves beyond energy consumption and emissions, blockchain technology is being recognized as a powerful tool to accelerate climate action. Leading global institutions, like the World Bank, United Nations Development Program (UNDP), and the Inter-American Development Bank (IDB) are all executing studies and projects that research and demonstrate the value of blockchains for climate action.

- The World Bank, for example, is supporting an end-to-end digital ecosystem for climate finance, which includes the Climate Action Data Trust.

- The CAD Trust platform uses blockchain technology to coordinate global carbon credit registry data.

- The WEF published a long report investigating how blockchains can be used to scale climate action.

Building businesses at the frontier of climate and blockchains

And an increasing number of climate tech startups are also leveraging blockchain technology for better. Climate-positive projects include Senken’s carbon credit marketplace; OpenForestProtocol’s digital monitoring, reporting and verification solutions, and Toucan’s infrastructure to tokenize environmental assets. As more projects enter the space, it will become increasingly important for all stakeholders (nascent and incumbent) to collaborate closely, to identify how to safely apply new technologies and drive mass adoption.

4 ways in which blockchain technology is driving climate action

Blockchains can help coordinate global climate action.

Coordinating international climate action is an incredibly complex challenge, where competing incentives of hundreds of individual state actors have to be managed. The United Nations Development Program (UNDP) is responsible for supporting more than 120 countries to strengthen Nationally Determined Contributions (NDCs). It concluded that a lack of integrated data systems (in addition to varying measuring methodologies) makes it challenging to set ambitious climate goals and accurately measure global progress.

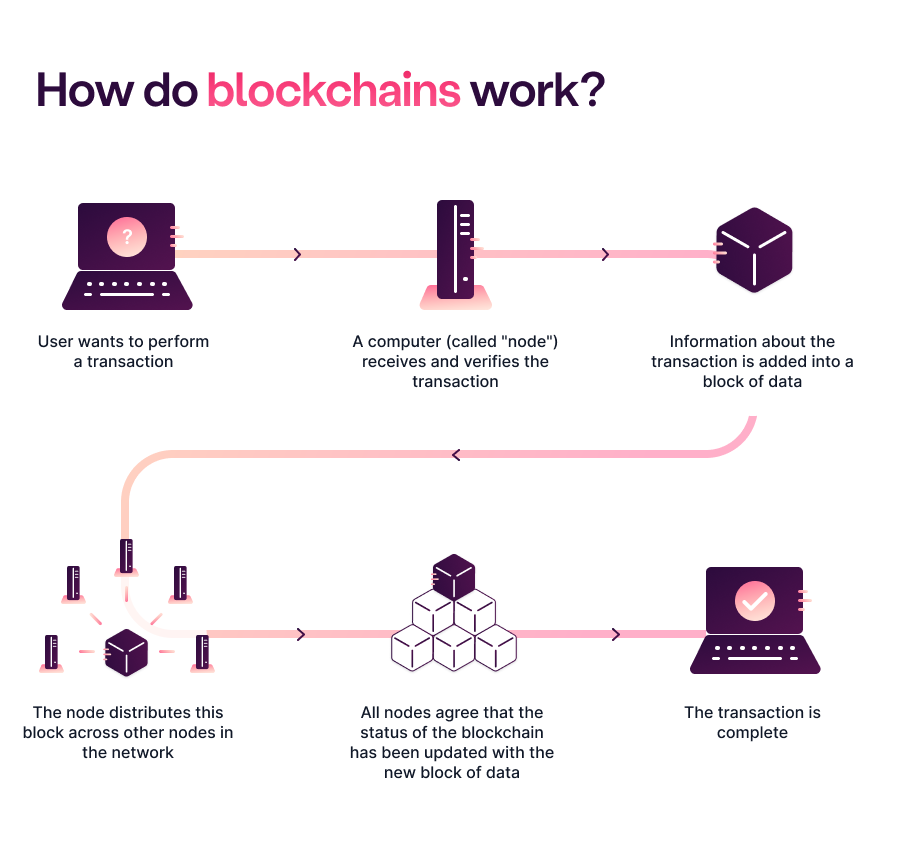

Blockchains can help address these coordination challenges. Tools like decentralized identifiers and verifiable credentials provide the data infrastructure and interoperability standards we need to coordinate progress against NDCs at a global scale. Blockchain-enabled climate accounting allows the alignment of incentives across government stakeholders that would otherwise be unlikely to trust each other. It also provides a path to solving fundamental accountability and incentive issues that are endemic to global climate negotiations.

Blockchains can be linked to digital MRV technologies to improve the credibility of carbon credit markets.

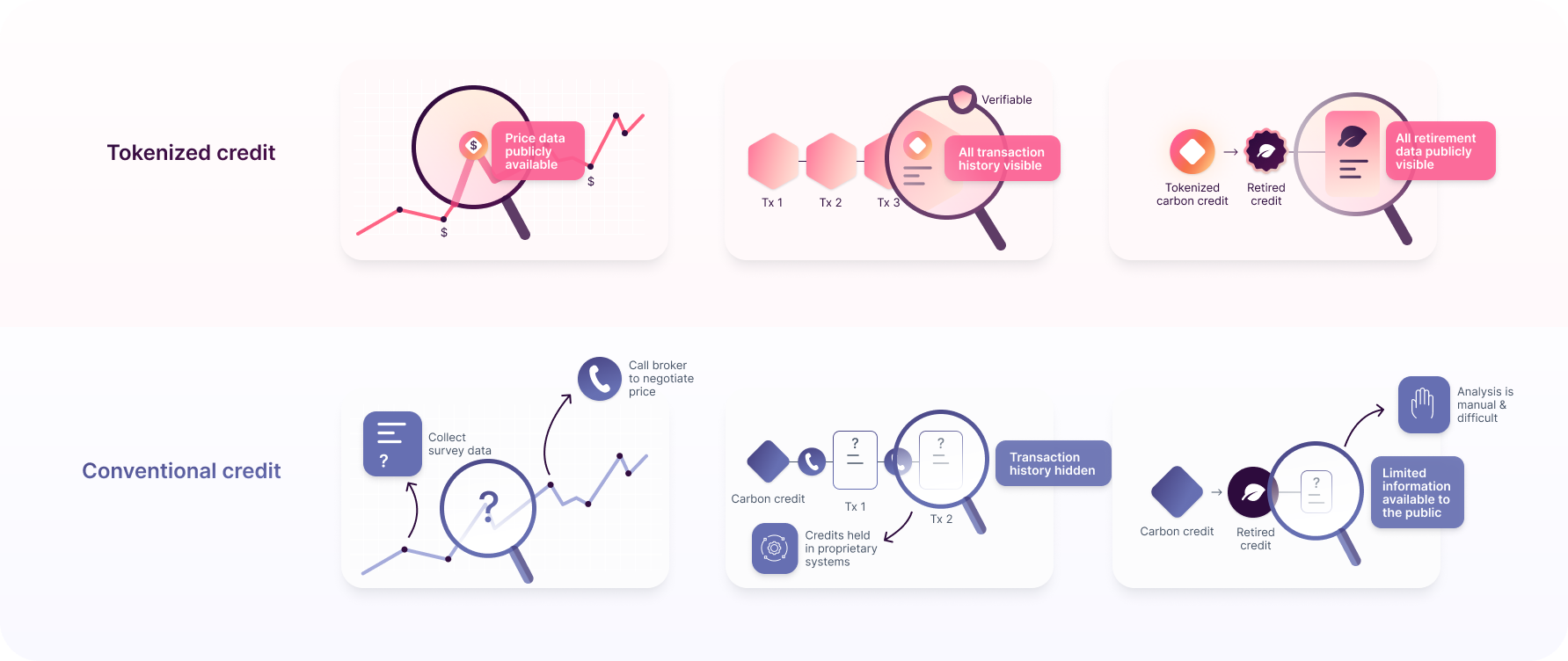

The voluntary carbon market (VCM) is predicted to grow exponentially: from $2 billion in value in 2021 to a predicted $50 billion in 2030. But transparency and integrity have become concerns as the VCM has begun to scale up to meet growing corporate demand for carbon offsets to hit net-zero targets.

Corporate buyers (and the general public) need to be confident in the quality and integrity of carbon credits that they are purchasing. Each credit needs to transparently demonstrate causal and durable change to greenhouse gas concentrations while also proving that they are free from credibility concerns like double counting or leakage.

Due to their public, accessible and machine-readable format, blockchains can provide the foundation we need for a trustworthy and scalable VCM. When carbon registries are built on blockchain technology, market participants can view a transparent digital record of every credit in the system. The result: Global price and supply coordination is possible. When paired with digital tools for measurement, reporting, and verification (dMRV) – such as smart meters and sensors, drone imagery, and data science – digital carbon accounting systems can provide real-time visibility into the actual effectiveness of ongoing carbon sequestration efforts. Such transparency removes risks for corporate buyers who want to make sure that their net-zero budgets are going toward measurable, verifiable climate mitigation efforts.

Digital carbon markets funnel more money to project developers.

Digital environmental assets (like tokenized environmental credits) help streamline asset discovery and purchasing. Project developers and buyers need fewer intermediaries who advise, broker, and manually collect and process data. This reduces transaction costs throughout the carbon value chain and helps on-the-ground project developers receive more financing.

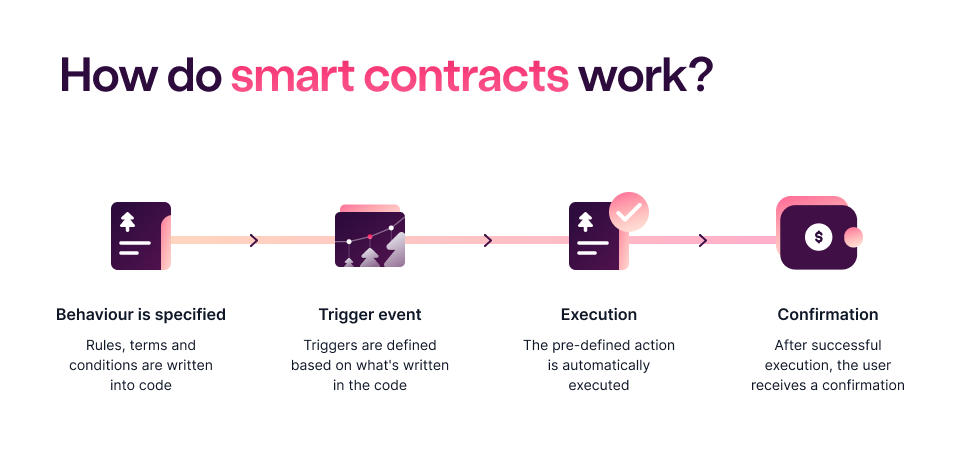

Digital markets can also help with early-stage financing. Project owners often use pre-purchase agreements to attract financing for their work. But without clear price signaling, they can be forced to offer their credits at a steep discount. In a more transparent carbon market, project owners may have more leverage in negotiations. Comparing prices can also make buyers more comfortable. And: Smart contracts can auto-execute pre-purchase agreements once credits have been developed, thereby reducing counterparty risk.

Fractionalization allows everyone to take climate action

Conventional climate finance markets are restricted to large institutions because carbon credits are typically not sold in volumes less than one metric ton of carbon sequestered. But digitized credits enable fractional (i.e. sub-ton) ownership of credits. This allows individuals and smaller organizations to participate in the market. Fractionalization is especially important for high-priced credits, like tech-based carbon dioxide removal (CDR) credits, which can cost hundreds of dollars per ton.

A generation of climate tech founders

Besides expanding access to carbon offsetting to the broader public, blockchain’s participatory culture unleashes a new wave of climate activists who see the technology as a tool for empowerment.

Toucan is building technology to unlock climate action at scale. Our digital infrastructure is helping to grow the voluntary carbon market (VCM) in a transparent and high-integrity way. It increases the flow of revenue to the most effective climate impact projects, by bringing established and nascent environmental assets on the blockchain.