WEF white paper: Blockchains' role in scaling climate action

We sum up key findings from the World Economic Forum (WEF) whitepaper Blockchain for Scaling Climate Action, from exciting trends to barriers to scale.

The World Economic Forum (WEF) has released its eagerly awaited Blockchain for Scaling Climate Action white paper. Built on seven months of research with industry leaders, the paper explores key trends, challenges, and opportunities that arise with the use of blockchain technology for sustainability. We are proud to have contributed to this whitepaper, alongside our friends from Climate Collective and other leading organizations in the industry.

In this post, we break down WEFs findings on:

- Scale of the climate challenge

- How blockchains can help scale climate action

- Current trends in the blockchain and climate action ecosystem

- Barriers to wider adoption

- Recommendations for accelerating climate action with the help of blockchains

Scale of the climate challenge

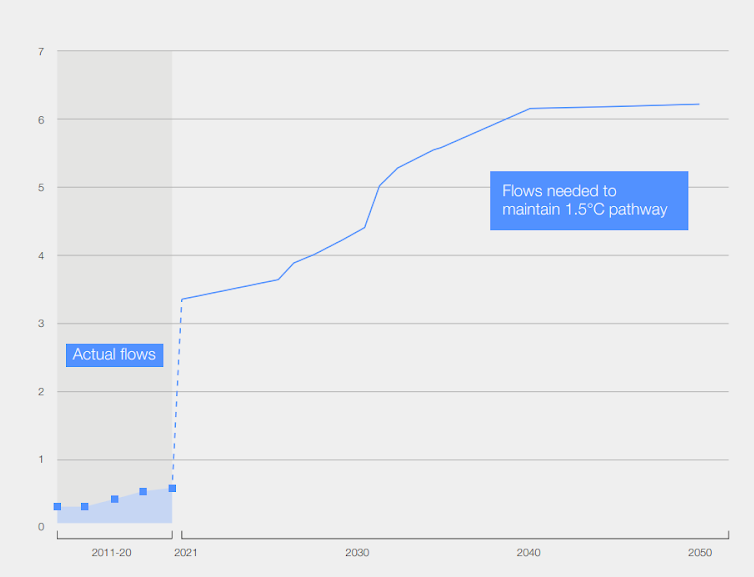

To date, the finance needed to meet global climate goals remains massively insufficient. This includes funding for key solutions like clean energy technologies, sustainable agricultural approaches, and zero-carbon cities. While $632 billion has been invested in climate finance over the past decade, the white paper highlights that this amount needs to increase to $4.35 trillion annually by 2030.

To hit this sum, we need new ways to make substantial, rapid investments in effective real-world climate mitigation projects, as well as methods to coordinate these efforts globally. Blockchain technologies are a key infrastructure that can bring speed and scale to fulfilling this mammoth task.

WEF specifically references the current inefficiencies relating to the voluntary carbon market (VCM). Despite being a key piece of the puzzle for reaching climate targets, the VCM faces issues at multiple points along its value chain. These include:

- a lack of access to funding for project developers

- poor monitoring and verification of climate benefits

- an opaque market where middlemen can make high markups on selling credits without being held accountable

Many emerging blockchain projects are aiming to make this market more transparent and efficient, demonstrating the value that blockchain technology can bring to climate tech.

How blockchains can help scale climate action

The WEF whitepaper identifies five key areas of climate action where blockchain technology could make a big impact:

1. Strengthen trust & participation in climate negotiations

Blockchains can be at the heart of systems that coordinate progress toward limiting climate change at a global scale. Their decentralized structure makes record-keeping trustworthy and tamperproof. As a result, climate accounting could be aligned across governments and private actors that are otherwise unlikely to trust each other. This provides a path to solving the accountability and incentive problems that currently slow down global climate negotiations.

2. Improve credibility & enable digital Measurement, Reporting, & Verification (MRV)

If blockchain becomes a core component of carbon markets, then all participants will be able to view a transparent, digital record of every carbon credit at all times, whether the credit is in circulation or retired. This allows for greater global price and supply coordination, and makes it easier to identify fraudulent sustainability claims. When paired with digital tools for MRV (including smart meters and sensors, drone imagery, and data science), real-time data can be included in a carbon credits’ record. This drastically increases the integrity of each credit and provides reassurance to organizations that use carbon credits to compensate for their emissions.

3. Funnel more money to carbon credit project developers

Carbon markets built on blockchains also can drive more money to carbon project developers. This is because they help eliminate middlemen that currently are executing the majority of carbon credit trades. As a result, direct sales can be made, which reduces the fees paid to middlemen. Blockchain also improves price signaling for pre-purchase agreements, which project developers can use to attract financing for their work. Purchases can be executed automatically with smart contracts once credits have been developed, which reduces the risk of non-delivery for the buyer.

4. Democratize access to climate action

Blockchain’s decentralized nature and open access can catalyze a new wave of climate action by younger generations, who see technology as a tool for empowerment. A great example is a blockchain-powered voluntary carbon market where credits can be broken into units of less than a tonne. This allows individuals and smaller organizations to participate in a market that they have previously been excluded from, as they can spend as much or little money as their budget allows.

5. Enable applications that incentivize climate-positive actions

Regenerative finance (ReFi) is an alternative to our current financial system that incentivizes and rewards planet-positive initiatives. ReFi intersects with climate technology, sustainable development, climate finance, economics, regenerative practices, impact investment, and climate justice. What remains foundational to all ReFi projects is that they seek to leverage blockchain technologies to build financial tools and create services that unlock an inclusive and regenerative economic system. Some areas that ReFi tackles:

- Real-time verifiable climate data aggregation

- Conservation and biodiversity

- Innovation in air quality monitoring

Most exciting trends in the blockchain and climate action ecosystem

The WEF whitepaper highlights several emerging trends in the blockchain and climate action space.

Using blockchains to improve existing climate initiatives

Blockchain technology has seen increased adoption by global institutions over the last few years. The World Bank, for example, has established the Climate Action Data Trust, which uses blockchain technology to coordinate global carbon data and pricing. This supports the success of its broader Climate Warehouse initiative.

Companies are developing more ambitious net-zero commitments

Corporate sustainability teams are ramping up efforts to find and fund high-quality decarbonization projects to offset their emissions. This is creating demand for a high-integrity voluntary carbon market. Blockchains can provide the digital infrastructure that can support a rapidly growing VCM, while also adding a layer of transparency to a previously opaque market.

Digital Measurement, Reporting, & Verification (MRV) solutions are emerging as a unifying market force

All market participants are uniting behind the value of digital MRV solutions to verify real-world natural assets. Creative solutions for enhanced verification have continued to surface over the past year, including impact certificates and renewable energy certificates. At COP27, the leading global carbon standard Verra launched an MRV pilot program with climate tech company Pachama. Blockchain technology will be key to supporting the effective implementation of emerging digital solutions.

Greater focus on climate data ownership and interoperability

Major institutional and regulatory bodies highlight the need for interoperable global data infrastructure to coordinate massive climate finance efforts. Many blockchain companies are building pieces of this global data infrastructure. Examples of this are Filecoins CO2 Storage platform and OneShot’s Open Carbon Protocol. The exciting part: all individual initiatives can seamlessly link up with each other.

Collaborative culture and the role of community

Entrepreneurs building at the intersection of blockchain and climate often have a strong sense of community. This is evident in the design of novel solutions and inclusive governance models, as well as in the wide recognition of local stewards’ rights to land and resources.

Barriers to wider adoption

As with the adoption of any emerging technology, barriers still remain before we can fully maximize blockchain solutions for scaling climate action.

Implementation at scale requires massive speed and coordination

The advantages that blockchains can bring to the voluntary carbon market are undeniable. But the industry now needs to “thread the needle” and implement significant changes quickly. This is difficult to do when working within an existing, entrenched market.

Reputational challenges of the carbon market and blockchain industry

As carbon markets and blockchain projects have grown, they have become increasingly scrutinized due to perceived credibility issues. There is a perception that the voluntary carbon market supports low-quality carbon credits that may lead to false claims by those using them to compensate for their emissions. Blockchain-powered solutions also need to overcome current stigma around their reputation, such as the energy use of Bitcoin.

Complexity and education gaps

The fast-paced, technologically complex nature of the blockchain-climate ecosystem presents a unique challenge in educating people on the value that this technology offers. The space needs spokespeople to communicate and build bridges with members of the broader climate community who are not blockchain experts.

Maintaining a focus on real-world impact

Due to the digital nature of the blockchain-climate ecosystem, organizations have been criticized for prioritizing digital engagement over real-world climate impact. Industry advocates have expressed concerns that it can be difficult to know the difference between a high-quality project and market hype.

Lack of regulatory clarity

Both blockchain and climate spaces suffer from regulatory uncertainty, preventing a more rapid emergence of solutions. For example, a lack of understanding of whether digital environmental assets are considered securities or commodities stalls progress in the blockchain sector. On the climate side, the Science Based Targets initiative (SBTi) is yet to publish guidance on what qualifies as a company’s net-zero contribution.

Recommendations for accelerating climate action

The speed of blockchain technology adoption depends a lot on policymaker engagement. This ranges from convincing national governments and utilizing global carbon registries to engaging local governments in community-level digital MRV technology.

Policy adoption, in turn, will depend on the development of regulations. It is important that these strike a balance between not stifling the innovation of new blockchain solutions and developing an environment of trust and integrity. And lawmakers need to increase their knowledge of the space to provide relevant, appropriate safeguards.

To help make this a reality, the blockchain community needs to focus on educating and building relationships with traditional climate actors to drive change forward! Demonstrating a focus on solving real-world climate problems and providing credible impact is also essential.