deCarbonized #14: Web3 for scaling VCM supply; Blockchain and clean electricity transition

Google scales up VCM interest with soil carbon venture; Rhode Island housing bill proposes the issuance of a green coin as an incentive to lower carbon emissions

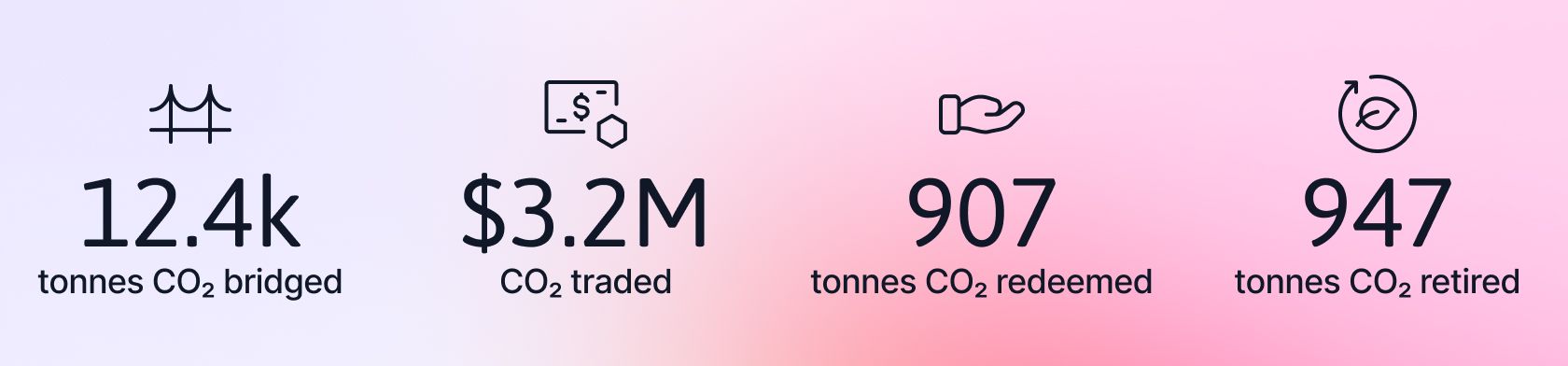

⛓ On-chain weekly carbon stats

Toucan Protocol is building carbon market infrastructure to finance the world's best climate solutions. These are our on-chain stats from 14.03- 20.03:

Stats explained...

- Bridged: Toucan’s Carbon Bridge allows anyone to bring carbon credits from legacy registries onto the Toucan Registry

- Traded: This figure represents the combined $ value of all trades in the Base Carbon Tonne (BCT) pool

- Redeemed: Anyone can redeem carbon credits from the BCT or Nature Carbon Tonne (NCT) pool and pay a fee to specify the specific carbon tonne that they would like

- Retired: Redeemed BCT and NCT tokens can be retired and claimed as a carbon offset

🦜 Want to learn more about Toucan? Join us at our open office hours, taking place every Tuesday 12pm EST/ 6pm CET on Discord

📢 Top news

- Google scales up VCM interest with soil carbon venture

- Rhode Island housing bill proposes green coin as an incentive to lower carbon emissions

- Exxon sees carbon capture and storage market reaching $4 trillion by 2050

- VCM quality drive not seen to solve the removals vs avoidance credit debate

🌟Web3 for tackling VCM pain points

Lack of supply side financing

Last week we introduced the potential for web3 to help tackle key pain points in the VCM, as identified by the Taskforce for Scaling Voluntary Carbon Markets. This week we dive more deeply into issues relating to supply side financing and some emerging web3 solutions.

📍 The pain point

Project developers are responsible for sourcing and initiating carbon credit projects around the world, producing a supply of carbon offsets. Their role involves:

- Bringing implementation partners and investors together

- Working with verification bodies to certify the quality and amount of credits a project will produce

- Bearing the financial risk of developing the project over a number of years

- Working with a network of distributors and retailers to deliver auditable, verifiable credits, which align with a purchasers offsetting claims

Ensuring that these steps are completed to a registry’s standards is a lengthy, rigorous and costly process. There is also a lag between claiming a certain amount of offsets will be produced and actual implementation, preventing revenue from being claimed for many years.

While some agreements are signed for the forward supply of carbon credits, contracts are unstandardized and there is little ability to buy or sell them. These forward assets are therefore illiquid, sitting on a balance sheet until the carbon credits are (hopefully) realised.

At present, it is therefore difficult for project developers to access upfront finance to develop high quality projects, as returns are perceived as risky and slow.

This issue is exacerbated by small project size, as many less well-resourced projects are unable to engage in the processes required to certify their carbon benefits and access carbon market revenues.

2021 saw multiple joint ventures between project developers and investors, especially in relation to scaling nature-based solutions like afforestation. While this better enables suppliers to scale operations to meet demand, it also risks concentrating project supply into the hands of a few larger firms.

This could create issues over distribution rights to large credit portfolios or effect the equity of engagement with local communities and landowners, as experienced with other large scale offset deals.

Therefore, while demand for new projects is growing, project development remains a risky business. While there is some new investment entering the space in the form of VCs like Breakthrough Energy and firms like Stripe, these interventions remain too small to boost supply levels to that required.

✨ How web3 can help

Web3 based solutions have the potential to contribute to overcoming this supply pain point in the following ways:

- Provide more reliable, upfront finance for project developers

- Reduce the complexity of project validation and increase access to revenue

Below we explore a few examples of projects emerging in the space. These solutions also make contributions to VCM pain points we will cover in later editions of deCarbonized, such as market transparency and credit quality.

💵 Provide reliable, upfront finance

Several projects are exploring how tokenized credits and communities of climate conscious crypto users can boost upfront capital for carbon projects.

BasinDAO works at the real-property level to develop and source high-quality, nature-based carbon removal credits. They leverage web3 as a hivemind for creative solutions and collective resources to enable the development and support of these projects.

Individuals and organisations engage by purchasing and holding BASIN tokens. These tokens give access to the forward purchasing of carbon removal credits at wholesale prices, with the option to invest in as few or as many offsets needed.

Solid World is a project instead focused on bringing greater security, liquidity and efficiency to forward markets. This will be achieved by tokenising carbon credit pre-purchase agreements, creating a public price signal that makes them both a more attractive asset and giving carbon projects more clarity on pricing. Tokenization will also allow for greater market liquidity, by enabling the creation of carbon credit pools for simpler purchase.

Solid World recently partnered with low carbon commodity company SCB, who are interested in involving this blockchain enabled approach in their future operations.

Finally, Eden Dao is an emerging supply-focused project, specifically focused on channelling capital the development of carbon dioxide removal projects. One means of achieving this is via the DRM Syndicate, where individuals can contribute to the collective purchase of permanent removal credits from Patch.io.

✅ Reduce complexity and increase access to revenue

Other projects are emerging that use web3 platforms to bring project developers closer to other VCM actors, streamlining the process of bringing quality credits to market.

Open Forest Protocol (OFP) is developing a blockchain-based, global community of forestation project operators, validators and funding partners. It aims to become the world’s first communal verification platform for forestation projects, bringing transparency and credibility to a streamlined market place.

This benefits project developers by creating access to affordable, easy-to-use MRV, which can be verified by the OFP community. This then creates opportunities to sell high-quality, data-backed credits to potential investors also using the OFP platform in an efficient way.

OFP are a partner of the Center for International Forestry Research (CIFOR) and currently involve 27 project developers. They recently signed a pact with Ivory Coast to work with local communities to sustainably reforest and restore 5,067 hectares of degraded forest land.

The Regen Network is a project that enables regenerative farmers and land stewards to assess, tokenize and sell the ecosystem services that they provide as carbon credits. This enables practices such as crop rotation and agroforestry to access and benefit from carbon markets. Regen currently engage 216 farmers and ranchers across 16.4 million acres of land.

Both OFP and Regen Network also facilitate decentralisation, increasing access to carbon markets for smaller project developers while maintaining carbon credit standards. This in turn promotes greater equity and local-level engagement, which is a key pillar of the ReFi (regenerative finance) movement within web3.

Next week we will explore the pain point of lack of market transparency 🔎

💼 Jobs board

- Managing Consultant, Business Advisory – Net Zero Transformation,

EcoAct - New York, UK - Head of Sustainability Standards, Climate Bonds Initiative - UK remote

- Commercial Carbon Market Business Consultant, World Fuel Services - US remote

- Carbon Market Strategist, TIME CO2, TIME - US remote

🔎 Research in focus

Blockchain for clean electricity transition

A recent report from Tecnalia and Chainlink Labs outlines how blockchain and accompanying oracle technology can help accelerate the transition to a clean grid via hybrid smart contract solutions.

Blockchain and oracles

Blockchain technology represents an important tool in supporting the clean energy transition. Able to provide a shared, open-source backend infrastructure, blockchain platforms can enable multiple stakeholders to track assets on a global ledger and enforce transparent agreements.

Blockchain can also be used to digitize and assign value to clean energy investments. This enables democratized access to green investment cash flows, transparency into the success of clean energy projects and drives stronger accountability around clean energy commitments.

Oracles are the middleware that deliver off-chain energy data onto a blockchain, perform secure off-chain computation and facilitate communication between different blockchains.

The combination of blockchains and oracles presents multiple opportunities for the energy industry to modernize its infrastructure and meet ambitious sustainability goals.

Key areas of application

The report outlines eight potential use cases for accelerating clean electricity transition, with potential case studies of their application:

- Tokenized carbon credits

- Decentralized Finance (DeFi) energy derivatives markets

- On-chain climate and green bond ratings

- Tokenized cash flows from clean energy projects

- Energy conversion contracts

- Insurance for renewable energy infrastructure

- Consumer rewards for sustainable consumption

- Grid management

Ongoing Challenges

While the possibilities enabled by the above applications are vast, there remain ongoing challenges to their implementation that require further research and development. The most notable of these include:

- Improved access to high-quality data and open-source analytics

- Prevention of stale or malicious data corrupting blockchain-based contracts

- Improved industry collaboration and the growth of clear standards

- Identification of viable jurisdictions to pilot initial use cases

The full report is available to read here.

🌳 Hot on blockchain

Coinbase Giving grants $500k to Toucan to kickstart Builder Hub

Toucan's Builder Hub seeks to make it as easy as possible for web3 developers to build projects using Toucan's carbon credit bridge and liquidity pool infrastructure. The Hub aims to expand the utility of, and end-user access to, these building blocks within new and emerging projects.

Builders will be able to gain free access to mentorship, events, workshops, educational content and grants for products at all stages. The first round of applications is open until Saturday 30th April.

You can read the full announcement here.

Toucan is building the technology to bring the world's supply of carbon credits onto energy-efficient blockchains and turn them into tokens that anyone can use. This paves the way for a more efficient and scalable global carbon market.

Thank you for reading deCarbonized! 👏

Reach out to us on social and join the community ✨

Suggestions on what to cover next? Let me know @DrHolWat