deCarbonized #17: Web3 for VCM integrity; improving standards of on-chain carbon

Solid World DAO secures €2.3 million to build pools for pre-purchasing carbon credits; Intercontinental Exchange launches its first nature-based solutions carbon credit futures contract

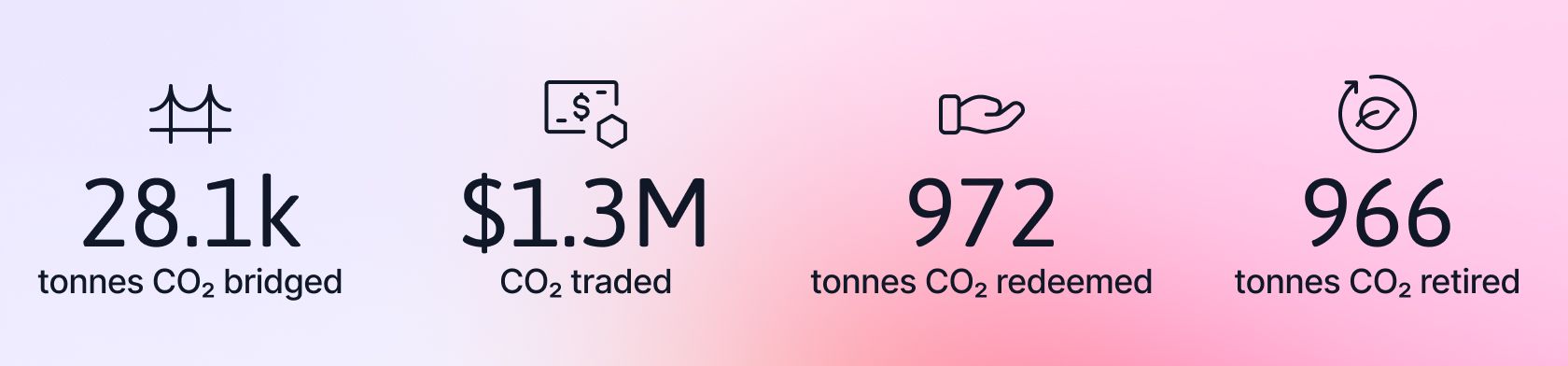

⛓ On-chain weekly carbon stats

Toucan Protocol is building carbon market infrastructure to finance the world's best climate solutions. These are our on-chain stats from 05.05- 11.05:

Stats explained...

- Bridged: Toucan’s Carbon Bridge allows anyone to bring carbon credits from legacy registries onto the Toucan Registry

- Traded: This figure represents the combined $ value of all trades in the Base Carbon Tonne (BCT) pool

- Redeemed: Anyone can redeem carbon credits from the BCT or Nature Carbon Tonne (NCT) pool and pay a fee to specify the specific carbon tonne that they would like

- Retired: Redeemed BCT and NCT tokens can be retired and claimed as a carbon offset

🦜 Want to learn more about Toucan? Listen in to our Twitter Space with Solid World DAO, or us at our open office hours

📢 Top news

- Blockchain-based climate projects respond to White House's request for information on Climate Implications of Digital Assets

- Solid World DAO secures €2.3 million to build pools for pre-purchasing carbon credits

- Global data provider Intercontinental Exchange launches its first nature-based solutions carbon credit futures contract

- African countries turn to mangrove forest carbon credit projects to earn revenue and combat climate impacts

🌟Web3 for tackling VCM pain points

Lack of credit integrity

Welcome to the final part in our series on web3 for tackling VCM pain points. This week we will be delving into issues of credit integrity 🧮.

The post below and those from previous newsletters are now all available to read on the Toucan Blog:

- Pt. 1- Introduction to the VCM and web3 🕵️♀️

- Pt. 2- Lack of supply side financing 💵

- Pt. 3- Lack of market transparency 🔍

- Pt. 4- Lack of credit integrity 🧮

Or if you would like to comment on or bookmark for later you can also find us on Medium.

Enjoy! 🌞

📍 The pain point

Alongside issues of transparency in the VCM, there’s an associated lack of quality assurance around carbon credits themselves. This has to be addressed if this growing market is going to make a credible contribution to climate action.

A carbon credit should mitigate one tonne of carbon from the atmosphere. To maintain integrity it should have the following characteristics:

- Additionality

A tonne of CO2 is considered additional if the avoidance or removal would not have occurred without money from the sale of carbon credits. This is hugely important, as if a credit is non-additional it has no real impact, making any carbon reduction claims false.

The methodologies and definitions around additionality are likely to change over time. For example large scale renewables projects have not been accepted by Verra since 2020, as the lowering cost of wind and solar technologies means that they no longer need carbon market revenues to be viable. - Permanence

Carbon avoided or removed should stay out of the atmosphere for 100,000s of years into the future. This means that credits linked to a forestry project may not meet this idea of permanence, as some of the trees may burn down or be deforested after just 10 years. To account for this kind of potential loss, projects are expected to produce a certain amount of ‘buffer’ credits beyond those sold . - Accuracy of impact

Project developers may overestimate potential CO2 reduction by miscalculating baseline emissions or failing to account for emissions leakage. This occurs when a forest preservation project for example, may trigger the deforestation of a different area.

There are also other characteristics that can give a more subjective measure of the quality of credits:

- CO2 avoidance vs removal

At present, the majority of carbon credits are based on avoiding CO2 entering the atmosphere as opposed to directly removing it. As more innovative removal solutions emerge, some organizations are now willing to pay $100’s and even $1000’s a tonne for removals-linked credits in light of their additional integrity. While there’s some debate around the value of removal over avoidance, there’s a clear need for both and an expected shift towards removals after 2030. - Sustainability co-benefits

There’s a growing interest in the co-benefits of carbon credit projects. Many organizations are interested in credits that not only offset their carbon footprint but show their commitment to environmental, social and governance (ESG) targets. A recent survey by the Forest Foundation found that 29% of respondents evaluated projects based on their co-benefits.

Issues of integrity

These types of credit characteristics are deceptively hard for projects to demonstrate, both in the initial design and in ongoing measurement, reporting and verification (MRV) across many projects.

At present, there is an oversupply in the market of what are now considered to be lower quality credits. This is due to many being many being of older vintages, which may be calculated using methodologies that are no longer being considered additional, have flaws in the way baselines were calculated or not including adequate amounts of ‘buffer’ credits.

Nearly 40% of carbon credits purchased by companies are more than five years old, with concerns that this might depress overall prices.

Conducting effective MRV is resource intensive and can create significant costs to the project developer. Monitoring requirements f are complex and inconsistent across project types which work to different standards and goals. Managing these requirements can drain much of the market value of the carbon credits produced.

Carbon credit projects may also bring about negative impacts on local communities, especially if they are not engaged during project design. There have been several high-profile cases associated with a lack of equity and inclusion and land rights, particularly in large scale forestry projects. MRV approaches should therefore also assess and transparently report these effects to maintain credit integrity.

This lack of standardised assurance around carbon credit quality can lead to negative publicity of offset projects and accusations of greenwashing, with large corporates needing to invest in independent checks on projects to ensure quality.

These issues contribute to a mistrust from the wider climate community, who view the VCM as a substitute for corporates in particular for reducing their emissions, with no clear, regulatory link to the achievement of the Paris Agreement and SDGs.

✨ How web3 can help

Web3 can support the scaling of high-integrity carbon credits by:

- Enabling digital MRV technologies

- Engaging and empowering communities

Bringing in these solutions alongside the tokenization of carbon credits (see previous post) is key to making the market more transparent. Let’s look at some technologies and projects that are building on the advantages of tokenized, on-chain carbon credits and connecting these directly with people on the ground to strengthen and guarantee integrity.

📡 Enabling digital MRV

There’s been a recent surge in the use of digital MRV technologies like internet sensors, satellite tracking and remote sensing. These can more quickly and efficiently collect data on project features such as forest cover and air quality, bringing more rigor and conformity to reporting processes.

Web3 allows this data to be efficiently, accurately and transparently recorded on the blockchain and directly linked to tokenized carbon credits, strengthening credit integrity. These advances require accompanying standards and practices to ensure that they enhance robustness and do not undermine the integrity they seek to create.

Open Forest Protocol (OFP) aims to make forest data MRV more accessible, affordable, and transparent by bringing digital MRV providers onto the same blockchain powered platform as project developers and investors. Earthbanc also uses satellite data, AI and web3 technologies to bring high integrity, verified credits to end users.

Wood Tracking Protocol is using blockchain technology to bring transparency and traceability to the wood industry, helping to prevent illegal logging in South America. Data recorded on the blockchain by local community members is then verified using satellite data to ensure wood is being harvested from protected areas.

✊Engaging and empowering communities

Web3 creates a decentralized way for local communities to more directly support and benefit from carbon market revenues.

OFP and the Regen Network create marketplaces for sustainable land management practices so that local project developers can connect directly with credit purchasers. This helps end users find projects that fit with their motivations and creates more direct connections with authentic projects without the need for middlemen.

Through web3, communities can receive direct payments for project implementation, which can be remotely monitored by digital MRV technologies and paid automatically. Organizations like Celo can allow people to receive payment from anywhere in the world without fees, using a mobile-based wallet.

In the future web3 could also assist with the upholding rights around property and community engagement standards- we’re just at the beginning!

💼 Jobs board

- Portfolio Partnerships/ Nature Based Solutions North America, EcoAct - New York, US

- Communications Lead, Toucan Protocol - Europe remote

- Carbon Markets Expert, Quantis - Italy remote

- Research & Development Manager Carbon Accounting, ClimatePartner - Boston, US

🌳 Hot on blockchain

Toucan raise standards in the on-chain carbon market

Toucan has added additional safeguards to improve the integrity of on-chain credits in the Base Carbon Tonne (BCT) pool.

A new rule came into effect this week stipulating that credits must have been issued within 10 years of their climate-positive impacts taking place, if they are to be bridged into the Toucan registry.

The BCT pool was developed with the goal of achieving deep liquidity. Due to this aim, the only credit criteria for entering the pool was to come from a project verified by Verra in 2008 or later.

It has since become apparent that previously dormant carbon credits, which had remained unissued by project owners due to limited market demand, have started to become active and bridged into the BCT pool.

Specifically, many of these credits were issued from older hydro electricity and energy efficiency projects. These projects have since shown monetary success without the need for carbon market revenue, bringing in to question their additionality.

Toucan therefore hope to prevent these lower integrity credits from entering the BCT Pool by creating a cut off of 10 years between their year of verification and credit issuance. It is hoped that this new acceptance criteria contributes to maintaining and improving the integrity of the carbon market.

You can dive into more detail on why the 10 year filter was selected and all the data in this blog post.

Thank you for reading deCarbonized! 👏

Reach out to us on social and join the community ✨

Enjoy deCarbonized? Suggestions on what to cover next? Let me know! @DrHolWat

Toucan is building the technology to bring the world's supply of carbon credits onto energy-efficient blockchains and turn them into tokens that anyone can use. This paves the way for a more efficient and scalable global carbon market.